The U.S. Supreme Court’s recent decision in favor of the administration in King v. Burwell should erase any lingering doubt that complying with the Affordable Care Act is now a reality for the business sector.

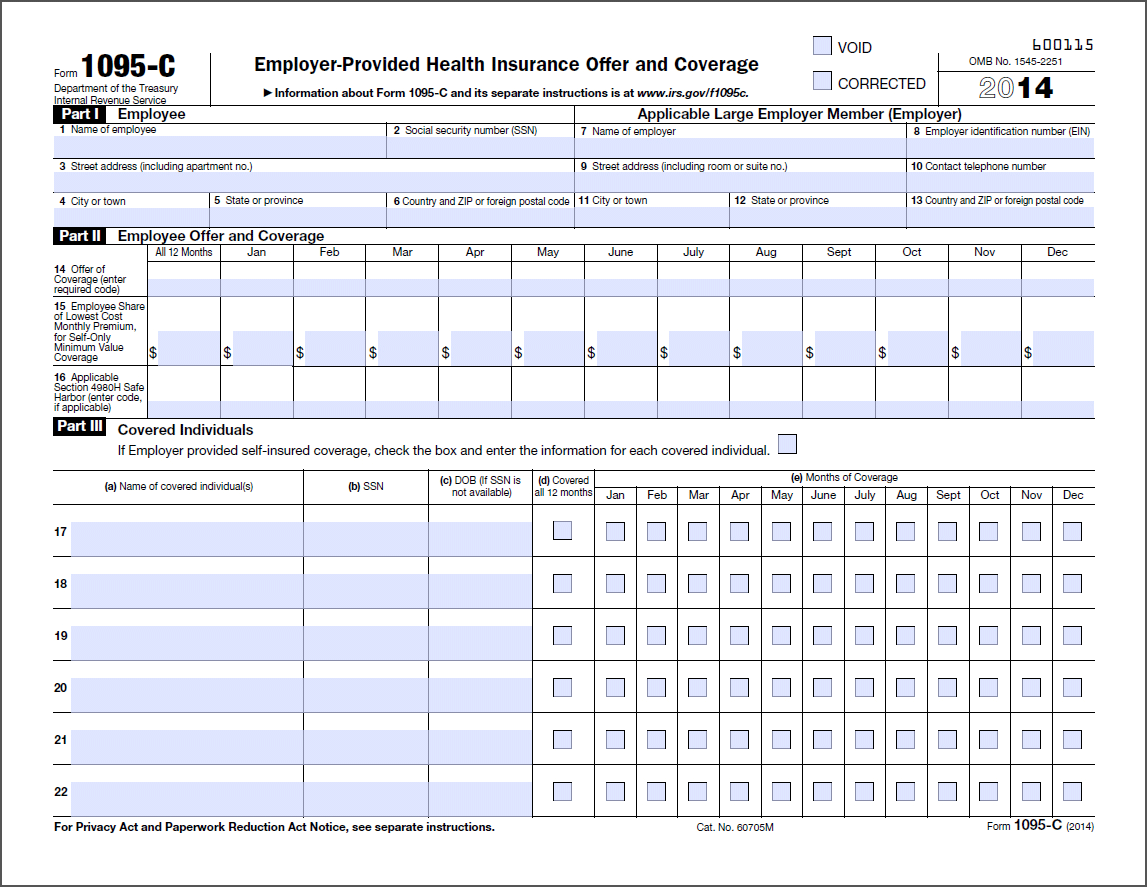

Now, virtually all businesses that employ more than 50 full-time workers will have to file new documents in order to meet the Act’s mandated individual and employer reporting requirements for the 2015 tax reporting year. These new documents, 1095-C forms, describe to regulators what coverage was available to which individuals so that those regulators can ensure it meets the law’s definition of “affordable.”

Employers must furnish 1095-Cs to their full-time workers by Jan. 31, 2016 and report them to the Internal Revenue Service, the primary enforcer of the individual and employer mandates, by March 31, 2016.

So, no big deal, right?

Wrong. Turns out there’s a lot businesses aren’t doing now but could to make ACA reporting a non-issue going forward.

Big responsibility for HR departments

First, we are finding that HR departments will have to absorb this responsibility at the vast majority of businesses to which the law applies. Health care is a benefit, and employers are reflexively handing the compliance requirements of it over to the people who handle other offered benefits.

This isn’t actually the ideal place for ACA compliance because the typical human resources department has not had to file documentation with the IRS before, nor have they had to oversee the process by which information makes its way from the company to the IRS in a compliant manner.

Further complicating HR’s eventual adoption of this new task is that it is not possible to beta-test solutions for 1095-C automation yet.

The IRS is not expected to release the taxonomies that guide automation of the document filings until August. What this means is that, even if a company or a vendor has technology set up to automate the filings, there is no live connection to the IRS for it to talk to. It would be like trying to call a phone number that’s been disconnected.

Similar to the actual filing, we have found that the burden to find or collect the necessary data will also fall to HR.

Data collection may be a problem

This, too, poses a potential problem. Even mid-sized or moderately large companies keep legacy information in a tangled mess of databases that are hard to sort or analyze. This is especially prevalent at companies that have been in business for decades.

So data discovery will be problematic, as the databases HR frequently uses are probably not the same databases in which all the required data for 1095-Cs are kept. In some cases, the company may have never even collected the necessary data at all.

Take one datapoint that 1095-Cs require: the Tax ID numbers of dependants who obtain health insurance from the employment of a spouse or parent.

It’s unlikely an HR department has ever collected this information, and many employers have never had a reason to collect and retain it in the first place. Obtaining it in a timely fashion could be a challenge for a company that waits until November or December to do data discovery because the first reporting deadline is at the end of next January.

Even typos can bring a fine

The bottom line is, well, the bottom line. There are steep penalties associated with batches of incorrectly processed documents — even making a typo can induce a fine — so vetting and testing the automation process is key to reducing needless financial risk, especially given that the process is unfamiliar to many HR teams.

Now is the time to get started.