“Technology — rather than hiring — is on the minds of most executives of mid-market companies.”

So says Mid-Market Perspectives: America‘s Economic Engine – Competing in Uncertain Times, a Deloitte survey of almost 700 executives at companies with revenue of $50 million to $1 billion.

A majority of the executives surveyed expect both revenue (61.2 percent) and profitability (52.6 percent) to increase next year, despite limited faith in any significant improvement in the national economy. What drives their optimism is a continued focus on cost controls and increased productivity.

Of the 70 percent of executives reporting an increase in productivity, the average saw a 6.1 percent improvement since the beginning of the recession. The majority of executives credit the rise to improvements in business processes (62.2 percent) and technology (50.3 percent), especially the automation of business operations and increased use of data analytics for business intelligence.

Less than 30 percent of the respondents attributed improved productivity to making better hires (29.7 percent) or better workforce training (28.6 percent).

As the report declares plainly, “if a job can be automated — if it can be reduced to an algorithm, an application, or a set of instructions — it probably will be.”

And the survey also made this point:

In short, technology — rather than hiring — is on the minds of most executives of mid-market companies It is important to have informed, creative, and empowered employees to interact with customers and suppliers. But to the extent that software can be substituted for people, companies are able to operate more efficiently, scale more easily, and generate higher levels of revenue per employee.”

While 44 percent of the respondents expect to increase headcount of full time employees next year, hiring is being restrained, 45 percent say, by the need to wring more productivity out of the company. Labor, say 49.3 percent, is the cost the company is most focused on controlling.

While 44 percent of the respondents expect to increase headcount of full time employees next year, hiring is being restrained, 45 percent say, by the need to wring more productivity out of the company. Labor, say 49.3 percent, is the cost the company is most focused on controlling.

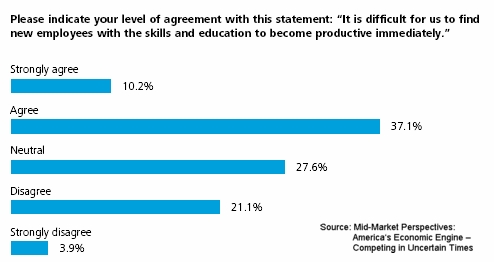

Another problem, survey respondents identified, was the challenge in finding new workers who can hit the ground running. The Deloitte report says 47 percent of mid-market business leaders report difficulty finding employees with the skills and education to become productive immediately.

This is becoming a hotly argued issue here on TLNT. A post Wednesday by editor John Hollon asks, “Are We Short of Skilled Workers, or Is it Just a Training Problem?” The post amplifies the discussion that began here with a reference to an opinion piece in The Wall Street Journal by Dr. Peter Cappelli.

He argued that employers are wrongly blaming schools for failing to train workers. “The real culprits,” Cappelli says,” are the employers themselves.”

What’s interesting to note in the Deloitte survey are the responses to the question, “What organizational changes, if any, has your company attempted to implement since the onset of the U.S. recession?” Of the eight options. 60.8 percent chose “Improved business processes.” That would be where streamlining workflow and automation fit in; essentially, the tech over talent decision.

“Improving training” was selected by 37.8 percent. “Higher standards, in terms of skills or education, for hiring new employees” was the choice of 35.2 percent.

According to Deloitte, the survey was conducted in July and August 2011, by OnResearch, a market research firm. They polled 696 executives at U.S. mid-market companies about their expectations, experiences, and plans for becoming more competitive in today’s difficult economy.

Respondents were limited to senior executives at companies with annual revenues of between $50 million and $1 billion; two-thirds of the companies responding were privately held, while one-third was public. The private companies were almost evenly divided between family-owned, closely (nonfamily) held, and venture capital-backed.

The industries surveyed were diverse; the two largest, consumer/manufactured goods and professional/business services, comprised only 25 percent of the responses. The other 75 percent were spread across 15 different sectors. IT and finance professionals contributed about one-third of the responses; operations and sales accounted for about 10 percent each.

Exactly half of the respondents were C-suite executives, owners, or board members; the other half included managers, department heads, vice presidents, or leaders of business lines.