The 15th annual National Business Group on Health/Towers Watson employer survey on purchasing value in health care that was released last spring has some interesting stats on consumer-directed health plans (CDHPs):

- Some 54 percent of companies have a CDHP and another 15 percent of respondents are expected to adopt one in 2011;

- 8 percent of companies offer a total replacement CDHP (only this plan), and this is expected to rise to 12 percent in 2011;

- Companies with at least 50 percent of employees enrolled in the CDHP see lower costs per employee — up to $1,000 per employee less than companies without a CDHP.

With initial cost savings like this, it’s no wonder more employers are looking at these plans. But pay close attention to this passage from the report:

For all the advantages of CDHP design to empower employees with greater responsibility for managing their own health, plan design alone is not enough to control future increases in costs… the way to differentiate on trend is through implementing effective programs to encourage employees to make better health care decisions.”

That is no exaggeration. My work with clients has driven home the importance of helping employees understand and use consumer-driven health plans.

How do you define a CDHP?

But hold up; let’s make sure we’re all defining CDHPs the same way.

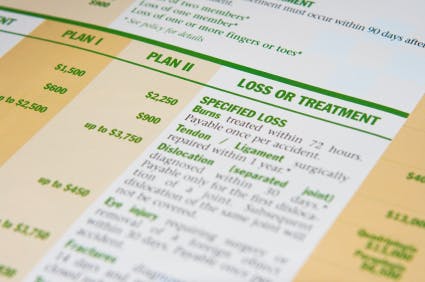

A CDHP typically offers members a lower premium (out-of-paycheck) in exchange for a higher deductible, some form of account to buffer the higher deductible, and a traditional copay/co-insurance model once the deductible is met. The best-designed plans include free preventive care and fund a portion of the account.The idea is that with their own money at stake, members will take a more active interest in getting the best care at the best cost — just like when you buy a major appliance.

That’s the concept. Reality and reaction have varied. The CDHP has been labeled as a plan that works for only the young, healthy, and kid-free — those who don’t traditionally require a lot of health care. Others have countered that’s not the case. Critics have leveled additional critiques: CDHPs alone don’t save companies money; the information necessary to make consumer decisions isn’t widely available; and, the plans cause people to skip health care because they’re unable to cover the high deductible, want to save their account funds for specific care, or just don’t understand how the plan works (note: more people are skipping health care these days, regardless of their plan type).

Employees need more education

The thing is, these plans are here to stay — at least for the foreseen future, judging by the numbers above. That means companies need to focus on educating employees about choosing and using CDHPs.

Back to those two clients:

Last year I worked with a global health care information services company to improve their U.S.-based CDHP enrollment communications. They knew the plan would work for many more employees than were electing it. The obstacle wasn’t the pricing; the obstacle was employees’ distrust.

In response, we devised a two-pronged approach to appeal to employees’ rational and emotional sides. We created communications that focused on the stats: who enrolls in these plans? How satisfied are they? What are their health and financial goals? And we created an interactive communication that let employees debunk their own fears while learning about the plan and their responsibility. Enrollment jumped from 4 percent to 7.5 percent, a more than 80 percent increase.

One example of CDHP issues

In 2004, I worked with another client to readdress some problems with their CDHP rollout. The company brought me in after enrollment to find out whether employees were becoming savvier health care consumers or delaying medical services. Unfortunately, we found many employees were putting off needed care.

Although their enrollment materials explained how the plan works and offered cost-comparison tools, many only saw the much lower premium. When it came time to cover the deductible, they were caught off guard. It didn’t help that employees were seeing the full cost of care on their explanation of benefits, those impenetrable statements you get from your insurer after every health care visit. Employees saw the mega-dollar signs, didn’t realize they weren’t on the hook for most of it, and stopped getting care.

We first addressed the immediate problem, delivering communications to plan members with real-life scenarios that explained how the plan works and translated the explanation of benefits into plain English. Next, we plugged this useful piece into their annual enrollment communication plan so all new CDHP members received it, and, we overhauled their ongoing benefits communication strategy to provide regular health care consumer-related education.

Since then, their enrollment and understanding has shot up. This year, 43 percent of eligible employees enrolled in the consumer-directed health plan. Based on their 2010 benefits survey, these members have confidence in their ability to make informed decisions (69 percent agree/strongly agree) and evaluate and select health plans and providers (62 percent agree/strongly agree).

The jury’s out on whether CDHPs deliver the goods, but we’re not done with them yet. So pay heed to the quote over the stats; misunderstanding’s a you-know-what.

This article was originally published on Fran Melmed’s free-range communications blog.