The last few months have brought seemingly unending news detailing allegations of sexual impropriety against politicians, celebrities, the news media, and other public figures. As a wave of victims march forward and social movements such as the #MeToo silence breakers grow, there are no signs that sexual harassment claims will subside. There is little doubt that companies and individuals across all industries have and will continue to see an increasing share of similar charges. As companies continue to address this crisis and attempt to protect their brand reputation from tarnishing, they may find some economic relief from their Employment Practices Liability Insurance (“EPLI”) coverage.

Types of EPLI policies

EPLI covers many traditional employment-related claims, such as those alleging age discrimination, discrimination based on ethnicity, wrongful termination, and retaliatory termination. EPLI policies typically provide insurance on a claims-made basis, which means that the policy responding to a claim in the one in place at the time that a claim is asserted against the policyholder and not the policy in place at the time of the alleged wrongdoing. Many EPLI policies provide broad coverage for alleged “wrongful employment practices,” “employment claims,” or similar catch-all terms. These terms are frequently defined to include a laundry list of possible offenses.

Sometimes EPLI coverage is included in or added onto Directors and Officers (“D&O”) policies or Management Liability policies. The EPLI coverage forms frequently contain “shrinking limits” provisions, meaning that insurer payment of defense costs reduces the available policy limits. This approach differs from many Commercial General Liability (“CGL”) policies, in which defense costs are covered in addition to stated policy limits.

Sexual harassment coverage

EPLI policies should provide coverage for sexual harassment claims, as well. One such EPLI insuring agreement provides, as follows:

“The Company will pay on behalf of the Insured, Loss for any Employment Claim first made during the Policy Period … for a Wrongful Employment Practice.”

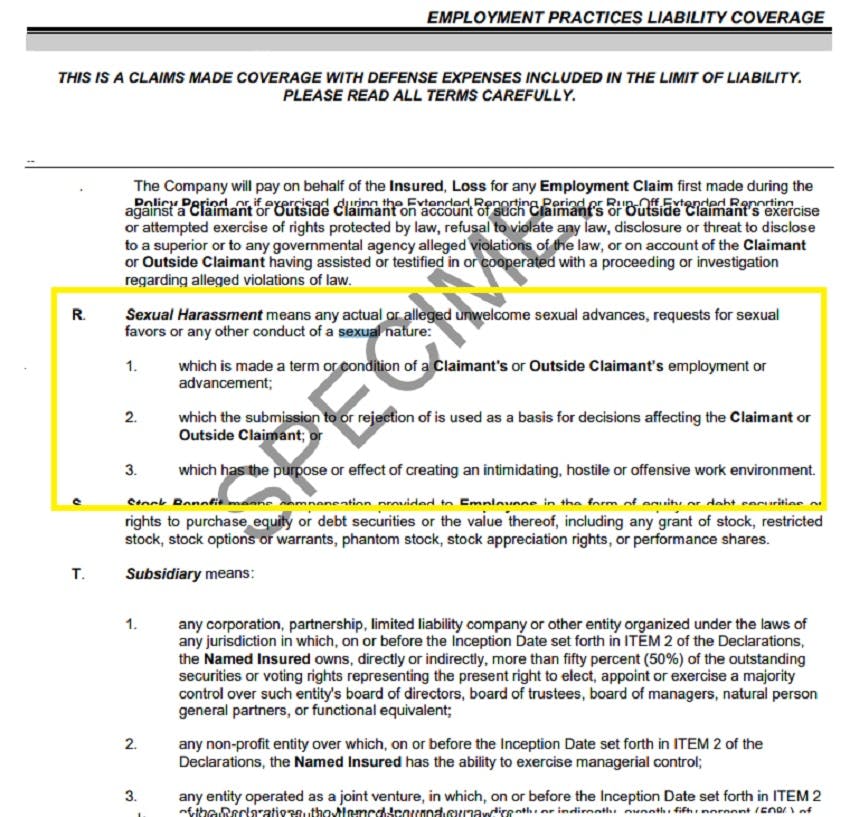

As we see with many EPLI coverage forms, the policy defines “Wrongful Employment Practice” to explicitly include any actual or alleged “Sexual Harassment.” That terms is defined, as follows:

“Sexual Harassment means any actual or alleged unwelcome sexual advances, requests for sexual favors or any other conduct of a sexual nature:

- which is made a term or condition of a Claimant’sor Outside Claimant’s employment or advancement;

- which the submission to or rejection of is used as a basis for decisions affecting the Claimant or Outside Claimant; or

- which has the purpose or effect of creating an intimidating, hostile or offensive work environment.”

EPLI policies often define the “Insured” as the company and also employees, members of the board of directors, officers, partners, trustees, and other equivalent titles. As a result, companies may be able to recover insurance proceeds to pay for its defense costs and potential settlements, if any, even if the allegations of wrongdoing are asserted against an individual within the company’s organization and not the company as an entity.

Accordingly, in addition to addressing all sexual harassment claims in the appropriate manner from a practical, human resource, and compassionate standpoint, companies should also put their appropriate insurance carrier on notice of any such claim.

Additional considerations

Claims alleging sexual harassment may seek punitive damages in addition to compensatory damages. EPLI policies vary significantly with regard to whether and when they will cover punitive damages. Some EPLI policies exclude punitive damages, other EPLI policies cover punitive damages if insurable under the applicable law most favorable to the insurability of punitive damages, and other EPLI policies cover punitive damages if they are insurable in any one of the following jurisdictions:

- where the punitive damages were awarded or imposed;

- where the alleged wrongdoing took place;

- where the insurance carrier or the Insured is incorporated or resides or has its principle place of business; or

- where the EPLI policy was issued or became effective.

The law on whether punitive damages are insurable varies from jurisdiction to jurisdiction. For example, courts in Illinois and New York, where many insurance carriers and major companies are located, have held that punitive damages are not insurable. Many companies, however, are domiciled in Delaware. Delaware law is favorable with respect to its rejection of public policy arguments on the issue of insurability of punitive damages and holds that punitive damage awards are readily insurable. It is important for companies be aware of the relevant language — frequently found in the EPLI policy’s “Loss” definition—and proactively negotiate the terms to best protect the company from a punitive damages award.

EPLI policies may attempt to dictate the lawyers that a company must use to defend a sexual harassment claim, or the lawyer’s hourly rate that the insurance carrier is obligated to pay for the defense. Perhaps unsurprisingly, the insurance carrier’s approved law firms may not align with the choice of law firm preferred by a company facing sexual harassment allegations against it or its employees. To avoid a dispute with their insurance carrier during an already difficult time, companies would be well-served to negotiate the counsel of its choosing before it faces a claim alleging wrongdoing.