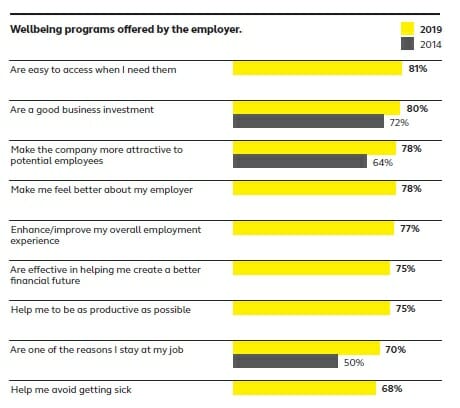

Employees see immense value in employer-sponsored wellbeing support. According to the Health and Financial Wellbeing Mindset Study from Alight Solutions, 70% of employees say wellbeing programs are one of the reasons they stay at their job — an increase of 20% in five years. Fostering a culture that encourages workers to enhance their personal wellbeing through integrated programs and experiences will better position your organization to retain and attract top talent.

While wellbeing programs are an invaluable investment for a company’s recruitment and retention strategy, Alight’s study also found there is room for improvement when it comes to employer-sponsored support. Among current employees, more than half say their overall wellbeing could be much better. This means employers can play a key role in holistic employee wellbeing, particularly with health and wealth-related benefits. There are several strategies that HR and talent professionals can use to support current and prospective talent in their wellbeing goals.

Personalize the experience

Employees believe they can make progress in their wellbeing with the right mix of tools and programs that fit easily into their lives. Employers should therefor focus on personalized and results-inspired communication providing 24/7 access to benefits plan information and delivering alerts and in-the-moment messages related to key wellbeing priorities employees may have.

Our study found millennials and Gen Xers are comfortable with sharing personal health information in exchange for personalized health and wellness guidance. Thus, employers have an additional opportunity to engage these workers by personalizing the process through more customized offerings, along with targeted communications.

Employees seek cost, options information

Employees are also looking for easy navigation options to help inform their annual health benefits enrollment decisions. Nearly three-fourths of employees have either compared costs between health providers or asked a provider about costs in the past year, which is a 5 point increase from 2017. This increase in consumer research means employees are not only interested in cost efficiencies, but would value tools to help them understand their benefits options. Consequently, employers looking to engage employees and stay competitive should provide health navigation support tools that research and provide employees with additional information on plan options.

Health navigation solutions that research cost-effective providers, offer second opinions to address health issues, or compare costs are great ways to meet the wellbeing needs of all employees. Offering these services alone does not guarantee that they are effective; as an HR professional, it’s imperative to thoughtfully market how these tools and services can make employees’ lives easier and the value they personally can obtain, not just the potential value to the organization overall.

Financial wellbeing

Financial wellbeing plays a key role in one’s overall health, and employers can offer a variety of health savings options, including health plans with health savings accounts (HSAs). It’s important to raise employee awareness and education around these programs, both for longer tenured employees as well as new hires and prospects.

In 2019, our survey found 42% of employees report they have yet to set aside money to cover healthcare expenses not paid by insurance; 23% say it’s because they can’t afford to. HSAs may help drive positive employee financial behavior. A third of those enrolled in an HSA tell us they save enough to cover at least some of their share of health expenses.

Planning for retirement is another financial wellbeing area that employers should capitalize on. 68% of all employees rank retirement savings plan decisions tools as the most valuable specific wellbeing tool. Among those whose employees provide them, even more (78%) rank them at the top. On average, 61% of all full time, private sector employees participate in their company’s retirement plan. Workers recognize the importance of preparing for retirement, and many employees have taken steps such as estimating how much money they will need in retirement and creating a financial action plan that details what is needed to retire successfully.

Employees may need additional support to increase their savings rates and tool usage as they work toward a financially secure retirement. Thus, employers have an opportunity to educate workers about support tools available and how financial wellbeing impacts an employee’s overall wellbeing.

Employer-sponsored wellbeing programs and resources can prove valuable in helping employees stay healthy and productive, and in making a company an attractive place to work.