As the Olympics come to an end, I’m proud of how many medals our American team is coming home with, but not quite as thrilled with the tax bill they’ll face for winning.

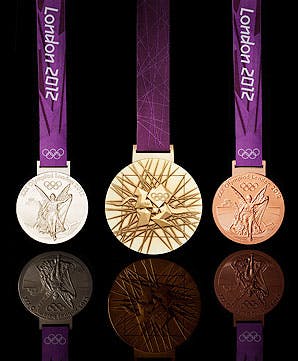

It’s not the value of the medal itself that the IRS wants its share of, it’s the prize money that comes with a gold, silver or bronze that is taxable. The U.S. Olympic Committee rewards Olympic medalists with cash honorariums: a gold medal brings $25,000, silver medals get $15,000, and a bronze is worth $10,000.

As calculated by the Weekly Standard, the IRS will take $3,500 of a bronze athlete’s winnings, silver medalists will owe $5,385 in taxes, and winning the gold (which is priceless) will set Ryan and Michael each out $8,986 per race.

Taxable or excludable awards?

Do you award prizes and incentives to your workforce? Even if it’s not a $25,000 gold medal prize, a $100 gift certificate to Amazon could cost your employees in federal taxes.

According to IRS Publication 525, employers must claim any cash or gift certificate awards or prizes on an employee’s W-2, and if the prize or award is goods or services, an employee must include the fair market value of the goods or services in their income. The only exception to this is for an employee achievement award that is not cash or a cash equivalent (such as a gift card) and cannot be more than $1,600 for all such awards they receive during the year.

Some examples of an excludable award would be a gold watch for 10 years of service, receiving a logo sweatshirt, or being treated to a fancy dinner. An extra vacation day would also not be a taxable event to your employee, and with summer’s end just around the corner, that may be the best incentive award of all.

Other non-taxable awards

As open enrollment approaches, keep this in mind. A great way to increase attendance at your open enrollment meetings is to provide incentives so you can fill the seats just as they did in London. Consider non-taxable prizes like offering a catered lunch or dinner, giving out company logo apparel, or even offering extra time off as part of a game about your benefits.

Let your employees go for the gold as they answer trivia questions about your health insurance and retirement program and reward them with something that WON’T mean sharing their prize with Uncle Sam.

This was originally published on the Financial Finesse blog for Workplace Financial Planning and Education.