I’m working with an employer who’ll offer only high-deductible health plans in 2013.

They’ve been offering this type of plan with a health reimbursement account for the past few years, so they know that educating employees about the plan design is important.

Without it, employees are often surprised when they get their first medical bill. Worse yet, they sometimes postpone getting care. That’s why my client’s amping up the education, starting with this year’s fall annual enrollment.

We’ve crafted a plan that involves newsletter articles, blog posts and other social media, and even two call-in radio shows. We’ve also agreed upon a high-deductible health plan educational game context developed that’s interactive, user-led and relies on scenarios.

Game scenarios offer a financial explanation

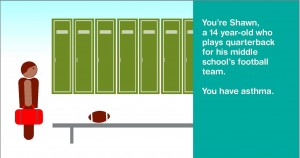

As customized for this client, the game consists of five characters and a simple, stylized design. There’s a 14-year-old high school athlete with asthma and a 55-year-old woman with unknown heart disease, for example. We intentionally created a few characters who have a chronic condition present in their workforce so we can also deliver ambient education.

To play, employees choose a character, determine the narrative and select the course of action. It’s an animated choose-your-own-adventure novel with a health twist. Does the 14-year-old have an asthma attack on the football field? The employee decides. Does he have his inhaler? Again, the employee decides.

To play, employees choose a character, determine the narrative and select the course of action. It’s an animated choose-your-own-adventure novel with a health twist. Does the 14-year-old have an asthma attack on the football field? The employee decides. Does he have his inhaler? Again, the employee decides.

At the end of each scenario, employees test their knowledge of how the plan works by figuring out who pays for the health care their character received. The five scenarios cover plan features that often confuse employees, such as what happens:

- With the shift from preventive to diagnostic care in the same visit;

- When they have no more funds in their health reimbursement account; and,

- If they experience a catastrophic case (the hit-by-the-bus scenario).

Each scenario runs roughly two minutes and provides an option to view a complete financial explanation, for those who want or need the fine print.

Employees are put in middle of the action

Employees are put in middle of the action

The game can be self-guided or used as a training tool. This client plans to host it on their benefits website so employees can work through the scenarios with their family. We’re also sharing the game with local HR representatives, who can guide a group discussion during annual enrollment employee meetings. A discussion guide is available to help HR run these meetings.

The advantage this game approach has over other print and media ones is that it puts employees smack in the middle of the action. They’re not passively flipping pages or strolling through comparison charts. they’re also not merely crunching numbers. They’re making decisions, just as they will in real life.

Making sure employees understand their benefits has always been critical. When you’re talking about high-deductible health plans the stakes are even higher, because employees are often drawn to the lower deductibles these plans offer and fail to prepare for their initial higher outlay.

Employers who want to contain costs and create health care consumers need to make their own higher initial outlay in the form of communication, training and tools. This game is one approach.

Editor’s Note: If you’re interested in learning more about this HDHP game for your employees, email or call 215-922-2525.

This was originally published on Fran Melmed’s Free-Range Communication blog.