Just pay people enough to take the issue of money off the table!

This seems to be the advice du jour. It is the centerpiece of Dan Pink’s recommendations for a better pay delivery model, it sits at the heart of the much touted membership model of pay and it reflects the concerns of many who believe that employers have overstepped in their move to more variable pay and incentives during the economic downturn.

But there is another side to this story that we’d be well-advised to consider. It comes to us today via the article Compensation: HR’s 21st Century Fuse Box, written by i4cp’s John Gibbons.

Gibbons draws a connection between the massive job cuts across major European banks (Bloomberg reports that over 70,000 bank jobs have been cut from the likes of Barclay’s, UBS and Credit Suisse) and the shift away from bonus to higher base salaries that began in 2009 in response to public criticism of bank bonus practices.

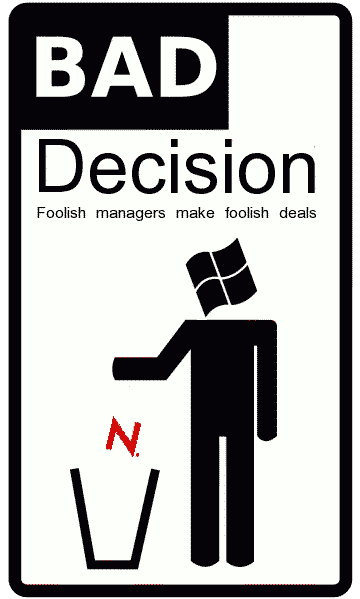

A compensation shift leads to layoffs

Many of the banks – ignoring the rule that pay dollars at risk are not equal to fixed pay dollars, and apparently reasoning that they couldn’t cut total cash and retain their talent – simply shifted total comp dollars from the bonus column to the fixed base salary column. Easy as that!

As John notes, this turned out to be a bad idea, particularly in Europe:

Most Americans don’t realize that, unlike the U.S. workplace, most European salaries are locked into place by employment contracts that are not flexible once an offer is formally extended and agreed upon with an employee. …

By shifting the emphasis of total compensation from bonuses to base, European compensation executives committed the fatal mistake of locking their companies into agreements with their employees, which resulted in commitments to continue to pay the high total compensation figures of 2008 – even while the markets continued to deteriorate. And to make matters worse, they made these commitments in Europe, where they had few options but to either continue to commit to these levels of total compensation or resort to layoffs.

Now we are seeing the results of these compensation executives’ decisions – more than 70,000 banking layoffs in Europe since July.”

Protecting employees from downside risk

Premium salaries and low-risk pay plans are an attractive idea, and I believe that they have application in some circumstances. They are not, however, a choice that should be made without careful consideration of what the future could bring.

Because when we aren’t thoughtful and forward-thinking about shifting cash compensation from variable forms into fixed base salaries, we are not really protecting our employees from risk. We could be, in fact, exchanging pay risk for job risk, the latter of which presents little upside (when you have a job, you have a job) and enormous downside.

Let’s be careful out there, shall we?

This was originally published on Ann Bares’ Compensation Force blog.