National insurance and wealth services firm, Alera Group has just released the findings of its 2022 Healthcare and Employee Benefits Benchmarking Report – a study into the benefits decisions made by 2,500 companies across the United States.

The results – which also record which benefits firms are currently providing – suggest employers are beginning to make significant shifts in their healthcare and employee benefits offerings as they attempt concentrate on attraction and retention in response to the Great Resignation.

So what are the key trends?

TLNT spoke exclusively to Danielle Capilla, its VP President of Employee Benefits Compliance to find out the answers:

Q: You hint at big strategic changes being made – what are these?

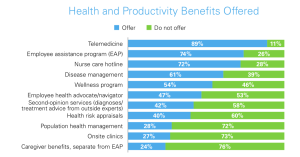

A: “What we’re seeing in this year’s data is that continued high job vacancy rates in the US combined with low unemployment are driving employers to make strategic changes to their benefits offerings to recruit and retain top talent. They are having to significantly expand their services – most prominent of which include more offering telehealth and behavioral health, as well as bolstering their wellness offerings.”

Q: What are the specifics around the bolstering of wellness benefits?

A: “Covid-19 clearly took a significant toll on employee health and wellness [one in five adults in the U.S. living with a mental illness, according to the National Institute of Mental Health], and what we’re seeing is that strategic employers are stepping up their health and wellness options to support employees both on the job and in their personal lives.

Of note, employers are bolstering their employee assistance programs to provide a broader range of services to support employees on the job and at home – from services support issues impacting mental health/emotional wellbeing, and work-related stress, grief and family problems.

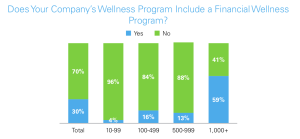

We’re also seeing employers recognize the impact financial stress has on productivity, with more employers adding financial wellness programs.

The percentage of US employers offering a wellness program with a financial component increased from 18% in 2021 to about 30% in 2022.

We think that number will continue to rise as more employers recognize the correlation between financial stress and employee engagement and productivity, and employees will begin to expect such offerings from their employers.”

Q: To what extent are employers having to respond to employee demand for better benefits?

A: “Employers definitely making changes to their medical plan offerings in response to employee demand for more choices.

Seventy-three percent of employers responding to the benchmarking survey offer two or more medical plan options, with preferred provider organizations (PPOs) and HDHPs being the most common plan types.

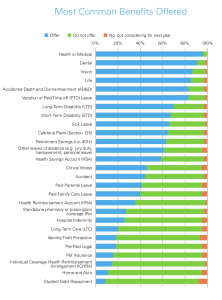

Medical, dental and life benefits remain the most common benefits offerings.

Large employers (500+) are more likely to offer more ancillary insurance benefits, such as Hospital Indemnity, Long-Term Care, and Critical Illness.

The use of telemedicine as a health and productivity tool is popular benefit among employers, the benchmarking report finds, with 89% of respondents offering telehealth services in 2022, up from 80% in 2020.”

Q: Isn’t all of this happening at a time of great anxiety around the cost of benefits?

A: “Yes. Cost containment was flagged up ‘the’ top concern of HR professionals (35%). This came ahead of by employee retention (32%) and recruitment (27%).

What’s interesting is that we’re seeing a number of strategies being employed to try and offset this.

Employers are implementing changes to plan design (39%); implementing narrow networks and increasing deductibles or out-of-pocket maximums (30%); and offering contingent cash for in lieu of insurance for spousal plan selection (21%). Employers are also implementing defined contribution premiums and using captives as alternative means of health plan funding to lower costs.

The majority of employers we surveyed indicate they are using more than one of these strategies to help contain costs while also providing high-performing plan options that meet the needs of their workforce.

Large employers (500+) are more likely to offer high-deductible health plans (HDHPs) with health savings accounts (HSAs) to lower costs. Many large employers are also issuing requests for proposals from plan carriers in search of a more economical option.”

Q: What other trends do you think the data shows as firms look ahead to this year?

A: “The benchmarking report confirms an ongoing shift in the workplace, with employers adopting a holistic approach to support the wellbeing of employees both within and outside the workplace.

As the employer-employee relationship continues to evolve, we believe employers must adapt and leverage benefits to support employee health and productivity.

Use of advanced healthcare strategies, such as point solutions, is one way employers can meet the diverse needs of their workforce.

Point solutions provide additional support tools to the organization’s core benefit offerings, targeting specific conditions, health needs and pathways to care. Diabetes management, fertility support and weight-loss programs are a few of the most common offerings.

However, only 30% of respondents to the benchmarking survey reported offering point solutions through their group health plan, while another 9% said they offer point solutions through an outside vendor. We need to see a shelving the the one-size-fits-all approach in favor of customizable packages that meet the unique needs of each employee.

This approach will provide not only a competitive advantage for employers, it will also ensure a generally happy, healthy and productive workforce of the future.”

DATA TELLS IT AS IT IS: Why It’s time to up-level your benefits

Human resources departments think they have great benefits, but employees disagree.

A global survey of 2,500 employees and decision-makers commissioned by Remote shows that 90% of decision-makers believe employees are satisfied with their benefits, but less than three-quarters (72%) of employees report satisfaction. This is an 18 point gap that, amongst a heightened global competition for talent combined with widespread economic challenges for workers, organizations can’t afford to ignore.

Employers are losing workers to companies with better benefits: 60% of employees say they have chosen one job over another because it offered a better benefits package, and over one-third of global employees have turned down or left a job due to issues or concerns with the benefits offered.

The rising cost of living has also emphasized the need for strong benefits. An overwhelming 88% of employees say that when money is tight, having good benefits that cover their fundamental needs becomes even more important.

In the event of frozen salaries due to a difficult economic climate, 79% of employees agree that offering a good benefits package can still set their workplace apart as an appealing place to work.

On average, remote and hybrid employees are significantly happier with their benefits packages than on-site employees. For them, telecommuting is at the core of their benefits hierarchy of needs. If their base desire for remote work is met, they tend to be satisfied with their overall benefits and perks package.

Yet, just as HR and employees differ on benefits overall, there is a 22-point difference between employers that believe they offer flexibility and employees who agree that they receive flexible benefits.

What knowledge workers today are looking for is true flexibility in where and how they work, not just a remote option. This includes the ability to move abroad, particularly among young generations: 54% of Gen Z workers say they would consider switching jobs to relocate abroad.