Note: This is the last of three articles dealing with managing performance and compensation in the post-ratings organization. Monday’s article discussed the broad issues raised when ratings are eliminated. Tuesday’s article presented the case for ratings.

————

Perhaps you have heard the following sentence described in a conversation about performance management, ratings, and the subsequent compensation decisions:

When compared externally, we’re a superior company. Therefore, when making internal comparisons of all employees’ performance, it’s acceptable and even logical to give the majority of our “Best People” workforce above-average performance feedback, and the resulting distribution of rating results should veer to the right.

This statement is methodically false, and an underlying root cause of dysfunctional performance management cultures in many organizations.

Why? In the entire process, it’s all about slicing the pie – bonuses, salary increases, long-term incentive (LTI) budgets, or promotion seats – among all employees, based on their performance and potential. Since you can’t give out more than what is available, the sum of all individual entitlements may not exceed the size of the pie.

Normally, the size of the pie is determined before individual entitlements are calculated. Above-par feedback (or ratings) understandably raise hopes of an above-average bonus, LTI, or salary increase. When such above-average expectations are not balanced out by below-average entitlements of other employees, the distribution equation ultimately does not come out even.

You can’t give more than you have

Mathematically speaking, the simple truth is: The weighted average of the entitlements of all employees must not be larger than the size of the pie divided by the total number of employees.

That’s why any external comparisons or benchmarks play no role at all in calculating the average baseline across the total population of employees in an entire organization or a sub-unit. The statistically relevant population for such distribution processes can only be the group among which the pie will ultimately be divided.

Comp budgets demand some form of calibration

The consequence of this is: If you permit performance feedback distribution curves that are above-average, that is, skewed to the right, you’ll raise profound and indeed understandable expectations among a majority of employees that they will receive above-average bonuses or salary increases (“Pay what you say”).

This propagates a system where proportional cuts to entitlements that have evolved from the feedback processes are inevitable; they are also known as “funding.” In absolute terms, this occurs because the sum of entitlements will always be bigger than the available pie. In this context, it is completely irrelevant whether the results of the employee assessment and feedback process are still called “ratings,” go by any other name or are officially abolished completely. At least implicitly – even if it’s only in the mind of the managers – there is always an evaluation, classification, rating, and finally ranking process that occurs as a necessary prerequisite to performance-based distributions of funds that are confined.

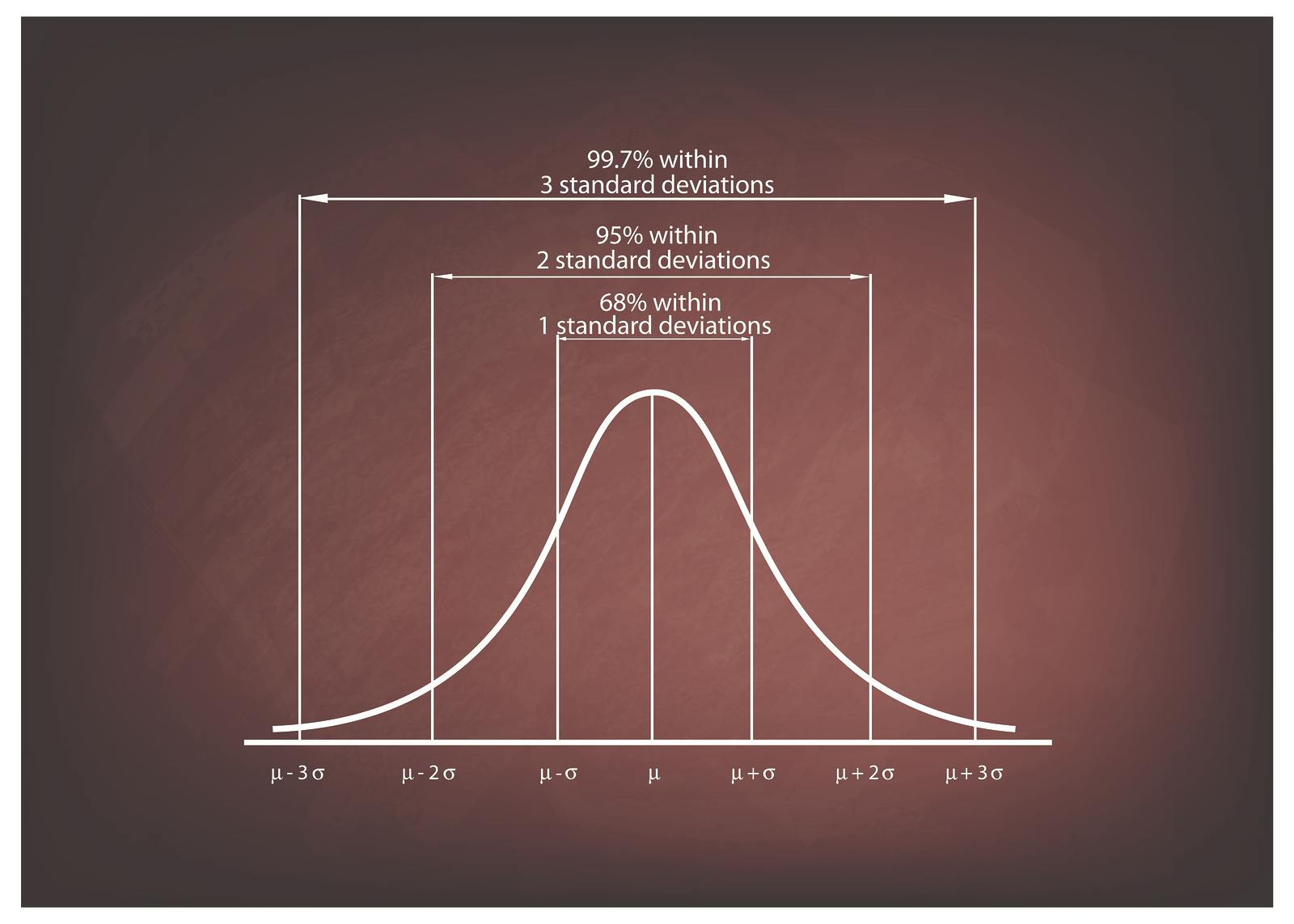

The mere mention of the words “forced distribution” or “Gauss curve” can trigger allergic reactions among employees and employee representatives. But, there’s actually no factual reason for this: In every system where the size of the allotted pie is fixed before the actual entitlements are calculated, the subsequent funding issue can only be circumvented if right-skewing evaluation practices are completely eliminated and the results of the performance process follow a normal Gauss distribution around a midpoint that matches the average 100% entitlement amount.

Whenever managers don’t adhere to such a Gauss curve, or when other forms of calibration across the organization don’t work as they should – in other words, if managers are allowed to give above-average feedback or assessments across their teams – then the pie at their disposal is smaller than the one they should actually distribute among their employees, according to the feedback they have given. Wherever we find this inconsistency of limited funds on the one hand and a lack of enforced norm distributions on the other, “funding” is inherent and inescapable, even if it is hidden and has been delegated to the individual manager level under the headline of “manager empowerment.”

Falling to the right or left of the curve

But, why does the application of the Gauss normal distribution logic to the total employee population of an organization or a unit then regularly lead to such an outcry?

Every sports team has its stars, average contributors, and bench players. The average of all the players’ abilities defines the standard of the team, or the “baseline.” This applies to a team in the Champions League as well as to a team in an amateur soccer league. Comparing these two teams or the players of the teams directly would be ludicrous.

On the other hand, no one would deny that the performance level of all the players on each team would fall to the left and right of their respective average team performance baseline.

This comparison from the world of sport represents the basic statistical framework ,which bar us from including players from other teams when we calculate the average relative performance standard within a team. For each team or each workforce that has a statistically relevant size and is assigned a comparable task (for example, Champions League soccer or customer service), it is necessary to define a dedicated, team-specific, and, in workforces, also a seniority-dependent performance average where all members of this homogeneous population can be relatively positioned to the right and left.

No above target performance?

Due to the dependencies between performance feedbacks and capped bonus, salary increase or LTI budgets, there is no such thing as individual above-target performance in absolute terms. The sole exception is usually in sales, where target achievement draws on a personal sales quota, which is an absolute figure. In this case, variable remuneration is therefore commission-based and not bonus-based.

For all other variable remuneration models, where the size of the pie is limited and pre-determined, a relative ranking of the achievements and performances of all individual employees within the relevant internal population is imperative as the basis for the subsequent allocation processes.

For the conceptual reasons explained above, any assessment process looking only at the objectives set for a particular employee and leading to an absolute rating and objective attainment statement without a subsequent relative ranking, doesn’t work when budgets are restricted and the pie to be distributed out is predefined.

Ratings are uncomfortable

Gauss curves with distinct ratings are often resisted because they make uncomfortable truths transparent. They force managers to apply differentiated and fact-based judgment, provide meaningful feedback and execute performance improvement plans. Funding, however, punishes all high-performing employees and cheats them out of their well-deserved rewards. The proponents of Gauss curve and rating-free feedback processes must therefore ask themselves which is the lesser of two evils.

The latest research driving the discussion suggests that employees hate ratings. I suspect it is often the managers’ poor people leadership capabilities that make the feedback process so unpleasant for employees, regardless of whether ratings are used or not. Managers trying to avoid the awkward task of confronting their lower performing employees and telling it “like it is” are therefore promoting the elimination of all performance management schema that urge them to clearly differentiate and make distinctive decisions rather than turning to florid, fluffy feedback language instead.

Only internal comparisons are relevant

Employees must once and for all abandon the idea – however emotionally enticing and seemingly plausible it may sound – that their company’s above-average success in relation to competitors on the external market equates with above-average performance by everyone within the company. The internal comparison of performance levels is the only relevant benchmark in this process.

Admittedly, this can be an unpleasant discovery and bring unwelcome consequences for good employees in a team of many, even better colleagues. Their only choice is to increase their own performance level or to look for another peer group. Once again, drawing the analogy to the world of sport: This is when bench players either start practicing even harder or transfer to another, most likely lower performing club.

Not everyone is better than average

The simple truth of the whole matter is: [clickToTweet tweet=”On average, not everyone can be better than average.” quote=”On average, not everyone can be better than average.”] If that were possible, we would have proven evidence for the existence of a perpetual motion machine.

Despite its obvious methodical impossibility, the statement quoted at the start of this article is reiterated again and again, resulting in many companies going round in circles in this important discussion. This is not a matter of HR philosophies or negotiable positions, but rather plain and simple laws of statistics and arithmetic reality. To deny or ignore these invariable facts in the current discussions about the future of performance management is neither expedient nor sustainable. As usual, methodical mistakes and factual misrepresentation won’t become any more valid through continuous repetition.