The importance of culture in making or breaking a merger/acquisition has long been an interest of mine.

After spending 25 years at the top outplacement/career transition business, I’ve seen the best and worst of people practices in M&A – and the best and worst of culture awareness in M&A. So I read with interest the recent white paper by Mercer, titled Culture in M&A: We Know It’s Important, So Now What?

And I found some interesting nuggets.

We all know this, but Mercer’s survey data show that “failure to address corporate culture is the key barrier in up to 85 percent of failed M&A transactions.” Yes, 85 percent. I’ll bet even your gut is surprised by that high percentage. Good to have hard data on that one, right?

Corporate culture: The key to a successful M&A

This is a short report, as white papers go, so if there’s a merger or acquisition in your future, I encourage you to download the report because the data is pretty compelling that culture should be a primary driver during due diligence and integration execution in a successful integration.

And who knows more about culture than HR?

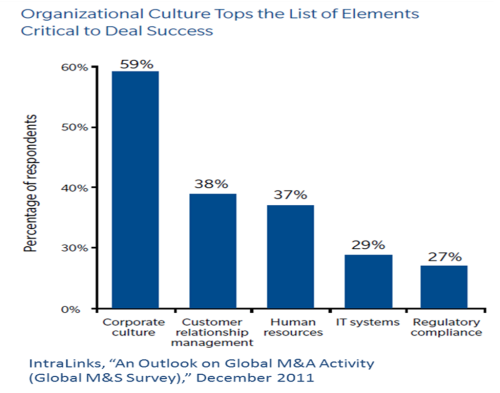

The relative importance of corporate culture as a driver of deal success as compared to customer relationship management, human resources, IT and regulatory compliance could be shocking to some – but not to leaders who have been on the wrong end of one of these deals.

HR need to be involved in due diligence

And by wrong end, I mean a due diligence process and integration execution plan that ignored the importance of culture and people, focusing solely on “cost synergies” and “accretive” value. In other words, a due diligence process and integration plan that didn’t have HR’s fingerprints all over it.

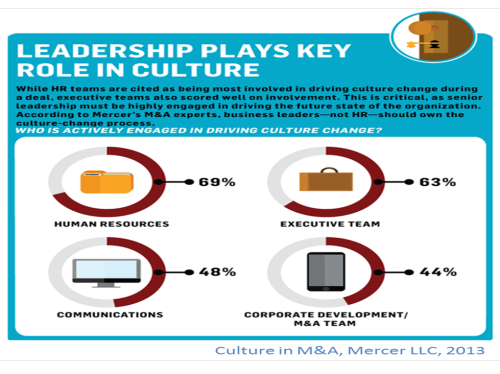

And if you need any more convincing, there’s this to consider:

So even if your focus is on achieving operational efficiencies, addressing culture in deals is a critical success factor.

And who knows more about culture than HR?

HR has the walk the talk of integrating cultures

Other topics covered (briefly) in the report include:

- Identifying company culture;

- Understanding target company culture;

- Analyzing data on culture;

- Using surveys to engage leaders;

- Planning for integration;

- Soliciting employee feedback;

- Tracking the integration process.

As you prepare for the deal, remember that although your CEO, CFO, Chief Communications Officer and head of corporate strategy may talk the talk about culture in an acquisition or merger, it’s HR (you!) that usually ends up having to walk the talk for the increasingly critical dynamic of integrating cultures.

And by the way, the “cost synergies” and “accretive” value never happen if culture isn’t the centerpiece of the due diligence and integration plans.

HR should be taking the lead

So look at it this way: since most organizations make HR largely responsible for the cultural integration piece in M&A activity, and failure to address corporate culture is the key barrier in 85 percent of failed transactions, HR has an enormous opportunity to drive up the success rate of M&A activity, quantify its value and participate as a full member of the organization’s strategic leadership.

As the economy improves and M&A activity begins to ratchet up at home and globally, HR is uniquely positioned to lead real bottom- and top-line impact by taking the culture integration mantle and running with it. And by running I mean creating the business case with hard data to ensure that culture issues are pro-actively dealt with even before due diligence begins.

Because who knows more about culture than HR?

This originally appeared on China Gorman’s blog at ChinaGorman.com.