Is talk of a global economic slowdown beginning to worry American workers?

That’s one explanation for a Gartner survey finding that a majority of US employees intend to stay where they are. According to Gartner’s Q2 Global Talent Monitor survey, 53% of US workers said they do not intent to change jobs. “This represents a 10% increase from 1Q19 to 2Q19 and the first time ever that a majority of the US workforce has reported an intent to stay in-seat,” said the consulting firm, noting that the global average was about 40%.

The Q2 report also found only 12.5% of US workers were actively looking for another job, about half who said that in the Q1 survey.

“With this quarter-over-quarter increase in intent to stay, we are now seeing a shift as employees hunker down, indicating concerns around available job opportunities and potential weakness in the labor market,” said Brian Kropp, chief of research for the Gartner HR practice.

This could mean even more trouble for employers trying to fill jobs. With a 50 year low unemployment rate making recruiters dependent on hiring workers away from other jobs, any hesitancy to jump ship will make filling positions even more difficult than it already is.

Adding to the bad news for recruiters and hiring managers is that Gartner’s survey also shows workers worldwide are losing confidence in the business climate.

All employees in the survey also reported less business confidence than they did in the Q1 survey. The confidence measure declined 2.4% from the previous survey. “Job opportunity perceptions across all major economies also fell in 2Q19,” said Gartner noting employees expressed decreased perception of options for employment in their locations, functions and industries.

In another finding, Gartner reported that about 21% of US workers said they were going above and beyond on the job. It’s the first time since the first quarter of 2018 that more than 20% workers reported high discretionary effort. It’s also greater than the international average of nearly 17%.

Kropp interpreted the survey indicators to suggest workers are “putting more time and effort into their current positions with the hopes of solidifying their roles in case of a change in the economy.”

The Conference Board’s most recent set of economic indicators supports what Gartner found. The Board’s Consumer Confidence Index took a dive in September, declining 9 full points since August. The Index (subject to revision in the next survey report in late October) now stands are 125.1. It was at a revised 134.2 in August.

Lynn Franco, senior director of economic indicators at The Conference Board, said, “Consumers were less positive in their assessment of current conditions and their expectations regarding the short-term outlook also weakened.” She speculated that the trade war that heated up in August may have spooked the public.

“However, this pattern of uncertainty and volatility has persisted for much of the year and it appears confidence is plateauing. While confidence could continue hovering around current levels for months to come, at some point this continued uncertainty will begin to diminish consumers’ confidence in the expansion.”

Among the factors that go into compiling the Consumer Confidence Index are the perceptions of survey respondents to the job market. Most of these were down in September from previous months.

“The proportion expecting more jobs in the months ahead decreased from 19.9% to 17.5%, while those anticipating fewer jobs increased from 13.7% to 15.7%,” The Conference Board reported. “Those saying jobs are ‘plentiful’ decreased from 50.3% to 44.8%, while those claiming jobs are ‘hard to get’ declined slightly from 12.0% to 11.6%.”

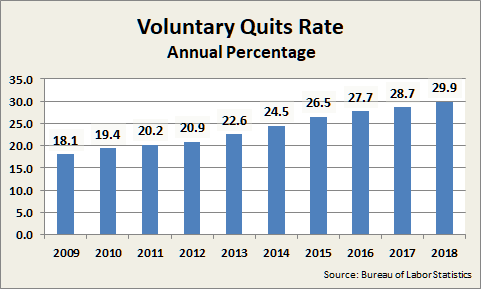

How this will translate into retention — or if it even will — is a question mark. The most recent data from US Department of Labor’s Bureau of Labor Statistics shows voluntary turnover at about 30%. In June and July, voluntary quits actually rose slightly. In July, the most recent month for which numbers are available, turnover was reported at 3%, the highest monthly rate in 10 years.

The next report on job quits and openings is due Oct. 9th and will report the results for August. This Friday, the BLS will issue preliminary numbers for employment and job growth in September.