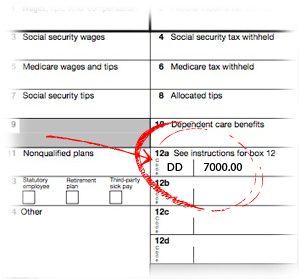

Have you had any of your employees question you about the DD in box 12 of their W-2?

No, it’s not a battery style or bra size but a new requirement for W-2 reporting as a result of the Affordable Care Act.

Effective with 2012 W-2 forms, employers with more than 250 employees are required to report the cost of employer-sponsored health coverage, and have the option of reporting the cost of a group dental or vision plan.

Luckily, the value of the employer contribution towards group health care coverage continues to be non-taxable (at least for now) and is meant to be for informational purposes only. The amount reported in box 12 actually includes both the portion paid by the employer and the portion paid by the employee.

Confusion over why this on the W-2

According to the IRS website, this reporting will provide employees with useful and comparable consumer information on the cost of their health care coverage. Based on several calls I have had over the past few weeks, it is also causing confusion and anxiety for employees.

Why have this information on the W-2? Unum.com states that the federal government will use the data collected from the W-2 cost reporting requirement to gain a better understanding of the aggregate value of health insurance and other coverage and services that are being provided through employers.

Why have this information on the W-2? Unum.com states that the federal government will use the data collected from the W-2 cost reporting requirement to gain a better understanding of the aggregate value of health insurance and other coverage and services that are being provided through employers.

At present, this W-2 reporting is the only way the government has set up to collect this information. It is the same information the government will need in 2018 to determine whether an employer’s plan meets the threshold for the 40 percent “Cadillac” excise tax.

A preview of the excise tax to come

Employee Benefit News provides a synopsis of this excise tax, which will impose a 40 percent excise tax on the value of coverage exceeding $10,200 for individual coverage and $27,500 for family coverage ($11,800 and $30,950 for retirees and employees in high-risk jobs) to be indexed annually starting in 2018.

All the last minute tax law changes due to the fiscal cliff, along with this new entry on your workforce’s W-2 forms, can be very confusing for employees. Don’t be surprised to find yourself bombarded with questions about them.

Consider including an article about the DD reporting in an upcoming newsletter or host a tax basics workshop or webcast for your employees to ease their concerns.

This was originally published on the Financial Finesse blog for Workplace Financial Planning and Education.