An additional 1.3 million workers could be eligible for overtime pay under a new compensation threshold proposed by the US Department of Labor.

The DOL is proposing to raise the dividing line between nonexempt and exempt workers from $455 a week ($23,660 annually) to $679 ($35,308). The threshold for Highly Compensated Employees (HCE) — those paid at least $100,000 annually, but who otherwise would be considered nonexempt because of their duties — would be raised to $147,414.

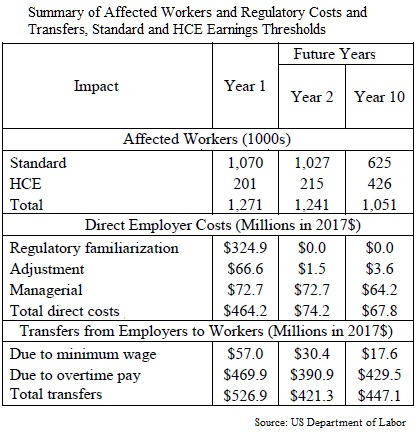

Estimates by the DOL indicate that the new pay threshold of $679 a week would make an additional 1.1 million workers eligible for overtime under the Fair Labor Standards Act. The new HCE would threshold would cover an additional 201,000 workers.

The DOL’s proposal, which runs 219 pages of background, detail and explanation, figures the higher pay thresholds will cost employers $470 million in additional overtime pay in 2020 when the new pay thresholds are expected to take effect. In addition, the cost of adjusting payroll systems, regulation familiarization and managerial time, is estimated at $464.2 million in the first year, falling to around $70 million thereafter.

While pay is a strong marker for determining whether an employee is exempt from being paid overtime, it is only one part of a part test the DOL has used for three-quarters of a century. To be considered exempt, according according to the DOL regulations:

- “The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed (the “salary basis test”);

- The amount of salary paid must meet a minimum specified amount (the “salary level test”); and

- The employee’s job duties must primarily involve executive, administrative, or professional duties as defined by the regulations (the “duties test”).”

DOL Fact Sheet #17A provides more specific details on the duties and salary basis tests.

To be exempt from overtime, a Highly Compensated Employee currently must earn at least $100,000, perform office or non-manual work and “customarily and regularly performs at least one of the exempt duties or responsibilities of an exempt executive, administrative or professional employee.”

Changes to the pay threshold were first proposed in 2016 by the Obama Administration. The DOL raised the threshold to $913 per week or $47,476 annually for a full-year worker and $134,004 for HCE. Bonuses and incentive payments would count up to 10% of the new salary level, a percentage unchanged in the latest DOL plan. Scheduled to go into effect December 1, 2016, the rule was challenged by 21 states and several business groups. A Texas federal court issued an injunction and eventually ruled in favor of the challengers, declaring the pay thresholds were set so high they “would essentially make an employee’s duties, functions, or tasks irrelevant if the employee’s salary falls below the new minimum salary level.”

The department appealed the decision, but asked the Court of Appeals to hold off while it studied issuing a new pay threshold. After conducting six in-person “listening sessions” around the nation and receiving some 200,000 comments as part of a 2017 Request for Information, the new pay rule was issued.

No effective date has yet been set. Before that happens the public will be able to submit comments about the proposed rule electronically at www.regulations.gov, in the rulemaking docket RIN 1235-AA20. Once the rule is published in the Federal Register, the public will have 60 days to submit comments for those comments to be considered.