American businesses are collectively losing $500 billion per year thanks to employee financial stress, or 11 to 14% of payroll expenses, according to a recent survey of more than 10,000 American employees. This stress negatively impacts mental health, reducing employees’ quality of life, productivity, and hurting relationships both at work with colleagues and at home with family and friends. However, by providing actionable solutions to deal with and avoid high cost debt in addition to financial education, employers can increase employee loyalty and productivity, decrease their stress and grow business revenue.

The mental health impact of stress

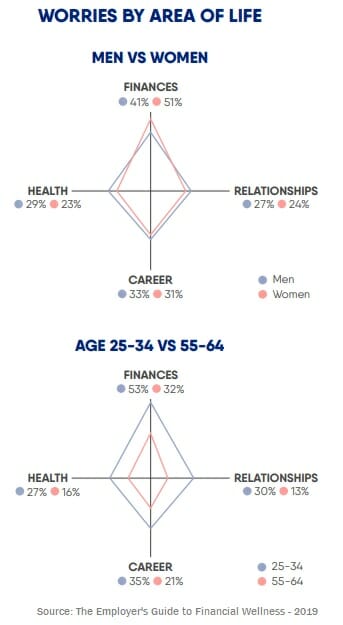

According to the survey commissioned by my company, Salary Finance, American workers of all ages worry more about money than their health, careers, or relationships, and only 6% of employees do not feel constrained by their financial realities. Financial stress is responsible for a myriad of mental health issues, making employees with money worries more than three times more likely to suffer from anxiety and panic attacks and four times more likely to suffer from depression and suicidal thoughts. They are also eight times more likely to have sleepless nights, leading to sleep deprivation that researchers suggest is comparable to alcohol impairment.

Money worries reach across employees in all industries and at all levels of experience and income. Even among workers who have more than three months’ savings for unexpected expenses, one in three is still worried about being able to make ends meet. This is supported by a recent PwC report, suggesting nearly half of employees find it difficult to meet normal household expenses every month. Only 31% of employees would be able to meet even basic expenses if they were out of work for an extended period of time. Millennials and women are particularly hard-hit; among those groups the number drops below one in four.

Some would expect financial stress to correlate with income and seniority, but our data suggests this is not true. Instead, financial worries decrease as seniority increases until the department head level, then increase back to early career anxieties at the C-level. One in four employees regularly living paycheck-to-paycheck earns more than $160,000 and approximately 40% of people making more than $100,000 per year are financially unstable. Saving and borrowing habits play a much stronger role in financial wellness.

Financial stress impacts business

Financial stress is not the kind of personal concern employees can check at the office or factory door. On average, employees with money worries spend more than three hours per week at work addressing personal finances, or nearly one month (23-31 days) of productive work days per year. This impacts employers of every size, costing businesses thousands of dollars in lost productivity per year, per employee.

Stressed employees are also much more likely to struggle at work and with their co-workers. They are nearly six times more likely not to be able to finish daily tasks and nearly five times more likely to have lower work quality. This impacts both the affected employees and the entire team; workers worried about money are more than four times more likely to have poor relationships with colleagues, reducing team synergy and morale. The additional stress from poor financial wellness means they are also more than twice as likely to be seeking a new job opportunity, lowering businesses’ retention rate and increasing overhead costs.

Help with financial wellness

Fortunately, employers are uniquely well-positioned to help. Our survey revealed 68% of employees feel their employers care about them and their wellness and 79% trust their employers with their financial information. Many major banks are still reluctant to lend to subprime borrowers, and charge high interest rates if they lend at all. This traps workers in a cycle of high-interest debt that can vastly exceed the original amount borrowed.

When loans are linked to salaries, the risk of defaulting plummets. This enables employers to partner with salary-linked loan providers to help employees consolidate their high-interest debt at a low interest rate. The advantages are manifold – employers are able to provide a new benefit to employees at no extra cost, while financially stressed employees are much more likely to be able to pay down their debt and begin creating a foundation of savings, improving their credit scores by 50-100 points. This positive trajectory reduces stress and increases productivity, creating a happier workforce that adds greater value to the company and the economy.

American companies cannot afford to continue to turn a blind eye to their employees’ financial wellness. Although historically employers have considered personal finances to be none of their concern, the connection between financial wellness and workplace productivity is now too important to ignore. Employers have been able to leverage their scale to lower the cost of insurance and other benefits for their staff. Similarly, now through salary-linked loans employers can help their employees avoid high cost debt and/or get out of debt and improve their credit scores. These conversations must be brought to the forefront to improve the lives of millions of Americans currently suffering.