Note: First Advantage is offering a free webinar detailing the changes in the I-9 form and process. You can register here.

For today’s employers, hiring and managing high-caliber, trustworthy employees is just the half of it. Organizations must also stay up-to-date with employment laws, regularly monitoring and managing their frequent revisions.

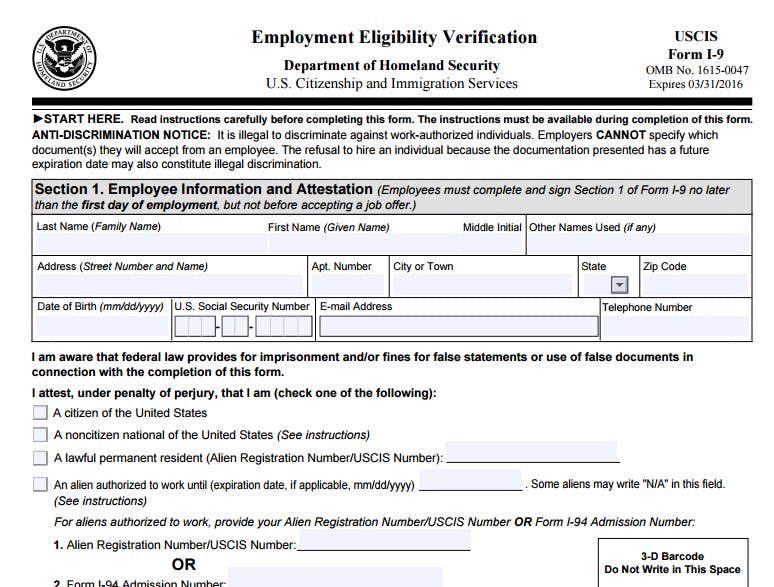

One of the most discussed hiring compliance aspects as of late has been the I-9, a form in which the U.S. Citizenship and Immigration Services (USCIS) issues and uses to verify the identity and eligibility of the vast majority of individuals employed in the United States since November 6, 1986. Requiring meticulous attention to its details and policies, as well as regular self-auditing, the I-9 stands out as a key document in employment compliance.

On Aug. 25, 2016, the Office of Management and Budget (OMB) approved a revised Form I-9, scheduled to be available Nov. 22nd. Employers may continue using the current version of Form I-9 with a revision date of 03/08/2013 N until Jan. 21, 2017. After Jan. 21, 2017, all previous versions of Form I-9 will be invalid.

Despite the importance of precise entry, there are many often overlooked or misunderstood aspects of the I-9 which, given changes, may leave employers at risk of fines up to $2,156 per non-compliant form (a 96% increase over the status quo) or otherwise exposed in the event of an audit from government organizations including the departments of Labor, Justice and Homeland Security. The rules are far-reaching – affecting almost any employer based in one of the 50 United States as well as the District of Columbia, Puerto Rico, Guam, the Virgin Islands and the Northern Mariana Islands.

In the modern era of electronic records, many employers question whether they should keep their records in a traditional storage facility or digitally. They also question whether these files must be maintained on-site or off-site. The reality is that any configuration of the above is acceptable. However, they must be in place for all current workers as well as for former employees up until the point when it’s been a full year since they’ve left the organization or three years since they were first hired, whichever happens last. (In other words, unless the worker was employed for a period of more than two years, an employer must hold their I-9 form for a period of at least one calendar year.)

Also, only authorized personnel are allowed to access these files, and it’s essential that I-9 forms and document copies always be kept together. Employers should never mail or courier I-9 forms to USCIS or the U.S. Immigrations and Customs Enforcement (ICE) agency. If the government does make an official request for this paperwork as part of an investigation, an employer must supply the paperwork directly within three days.

Given the history of compliance confusion and a future of near-term change, now would be a wise time for employers to consider conducting an internal audit of their I-9 compliance program to determine which, if any mistakes may exist and where training and clarification may be needed.

First Advantage has partnered with David Basham, outreach analyst at U.S. Citizenship and Immigration Services, to better educate employers about form I-9. At the September 29th webinar, “The Real Deal on Form I-9,” registrants will learn everything from when an employer must certify the paperwork to the proper ways to copy documents to what to do if an I-9 is missing or damaged.