With Christmas barely a couple of weeks away, and the end of another busy year fast approaching, the season of goodwill is arguably the perfect time for HR professionals revisit and revise their policies around charitable donations.

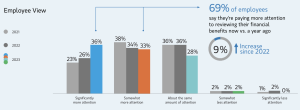

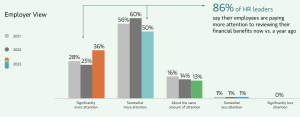

The trend of employees looking to their employers for financial support is only growing stronger, whether it’s financial guidance, retirement planning, or education reimbursement.

As we look for ways to extend kindness to our neighbors, communities, and causes we care, charitable giving is no exception, especially in these less certain economic times, when employees may be struggling to find a way to balance their own financial goals against the desire to do some good.

But if you’re stuck between your own cost-cutting FD and CEO, here’s why HR professionals should be signing the praises of charitable giving:

Charitable giving benefits can contribute to a culture of meaning and support

The workplace has become the go-to resource for employees to address their personal financial needs, both in terms of generating income and determining what to do with it.

Charitable giving is an important way to help fill our cups, building stronger connections to the wider community while also giving us a greater sense of purpose.

Bringing this sense of meaning into your workplace benefits suite, alongside the more traditional fare, can create new opportunities to enrich your professional culture and support employees in managing their money in a way that also helps them feel empowered to give back.

This kind of support and emphasis on giving through work is even more important in our unpredictable economy, where even executives may be concerned that they may not be able to spare the time, energy, or resources they’d like.

But workplace benefits can help streamline the process and lift potential tax burdens, enabling employees to take a more active role in the causes they care about while also giving them a greater sense of belonging, support, and meaning through your company.

Charitable giving helps elevate more traditional benefits packages

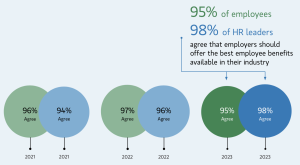

Our own research shows that most employees and HR leaders (95% and 98%, respectively) agree that employers should offer the best employee benefits available in their industry, especially when it comes to attracting and retaining top talent:

Charitable giving can help elevate and enhance your benefits suite by helping employees streamline their financial planning in a way that complements their benefits elections, overall goals, and tax management needs.

For example, a charitable-giving solution can help centralize the process for companies and their employees to make donations through a donor advised fund (DAF) platform, creating an effective framework for making tax-advantaged donations directly to favorite charities, including assets like mutual funds, artwork, cryptocurrency, private stock or equity compensation from an employer.

Additionally, a DAF can help company insiders and executives who receive equity compensation leverage their shares for charitable donations and tax-loss harvesting.

Charitable giving can offer employees more financial planning choices

Workplace benefits, including charitable giving, gives employees more choices to explore as a part of their overall financial ecosystem.

For example, taxes may feel far away when making year-end charitable donations, but a holistic and centralized workplace offering can serve as a first stop for employees to create a strategy that incorporates charitable giving, but also connects to all the other areas of their financial life.

For example, a charitable giving benefit combined with access to financial guidance can help employees make more efficient decisions about the timing of their donations for tax purposes, or help them zero-in on which assets make the most sense to donate.

There isn’t one right answer, and holistic workplace benefits that include both charitable giving and financial coaching (or access to financial advisors), can help employees put together the pieces in a way that makes the most sense for their individual situations.

Additionally, well-structured education modules around topics like philanthropic planning and taxes, as well as intuitive charitable giving and equity compensation platforms, can also help provide support and guidance on how employees can maximize their impact both with their intended charity and their overall financial goals.

Employees want to know their company cares

A holistic benefit offering should include thoughtful choices, like charitable giving, financial education, and access to advice, which can work together to provide employees with many pathways to customize their financial strategy and derive greater value from their role at your company.

And as more workers seek employers that align with their own personal values, this benefit can become a strategic addition that helps foster a culture of engagement and meaning within organizations.

Look for new ways your benefits offering can be a powerful tool in helping people fulfill the desire to give back, while also protecting and maintaining their own financial wellness.