Nobody wants to think about getting sued.

And most business owners like to think that if they’re doing their due diligence, doing right by their employees, and paying everyone on time — maybe even throwing in some extra perks like bonuses — that everything will generally work out okay.

The unfortunate truth is, while you might not like to think about the possibility of lurking lawsuits, plaintiffs’ attorneys do.

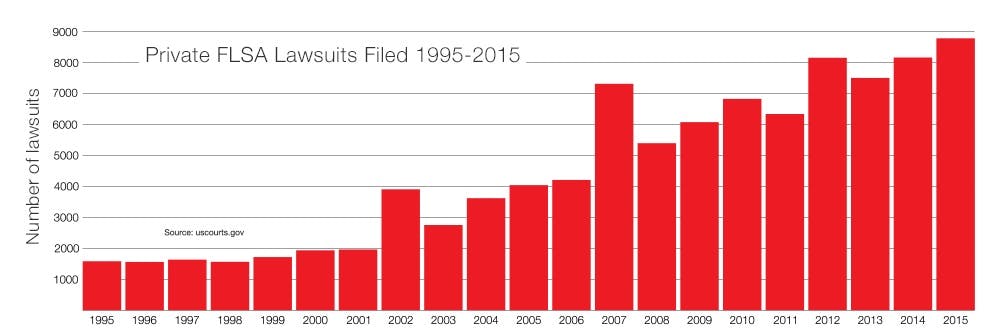

And the staggering rate at which wage and hours lawsuits have increased — 456% since 1995 — should be an indication that, as employment law specialist Daniel Abrahams says, “A dispute with the Department of Labor or a group of employees doesn’t mean you’re a bad employer. It just means that you ran afoul of some very complicated rules.”

Preparing for the worst case scenario, rather than hoping it won’t happen to you, is critical to mitigating damage, limiting expenses, and protecting your company and employees.

So, what do you need to know about wage and hours lawsuits?

Understand that plaintiffs’ lawyers are actively soliciting your employees. Why? Because in the event that an employee is successful in bringing a wage and hours claim against your company, you’ll be liable for not only your own legal fees, but your employee’s legal fees as well.

“I sometimes joke that the Fair Labor Standards Act really stands for ‘Fees Lawyers Slobber About’,” says Lee Schreter, an attorney with Littler Mendelson. “But in all seriousness, it’s a huge driving force in the numbers we’re seeing.”

Know that wage and hours cases are notoriously difficult to settle. For the aforementioned reason, there’s a lot of incentive for plaintiffs’ lawyers to rack up fees rather than settling quickly. Having your ducks in a row and records in order is crucial to achieving a settlement instead of a trial.

Abrahams says, “This often makes it quite difficult to settle these cases quickly, because the plaintiffs’ lawyers have a vested interest — at least economically — in running up their fees and incurring certain costs prior to settling the case. It can be extremely hard to get a resolution of these cases right at the beginning.”

Keep a pulse on the courts, not just the law. “About 20 years ago, we saw wage and hours cases being filed for pretty straightforward compliance issues that employers had simply missed. Over the past 20 years, that has changed dramatically,” Schreter observes. “Now we find that even very sophisticated employers are the targets of successful suits.”

Knowing the letter of the law is one thing. Understanding how that law is morphing and being reinterpreted in courts on the daily is another — and crucial.

Don’t assume you’re right. Automatically assuming you’re correct while your employee is just blowing smoke isn’t going to do you any favors. “When it comes to wage and hours complaints, a good offense is not necessarily an appropriate response,” counsels Abrahams.”The first appropriate response is to figure out if the worker is legally correct and whether you ought to be taking some kind of corrective action.”

Understand that speed is of the essence. Speed is of the essence when it comes to wage and hours lawsuits in multiple ways. Failing to respond to an employee’s complaint in the short window of time you’re allotted can mean that the statute of limitations (typically 2 years in an FLSA case) gets thrown out the window. It also means that those legal fees just keep accumulating for your employee. Having accurate time data and accurate records is absolutely critical.

Keep it classy. Being antagonistic toward the DOL or your employee’s legal counsel is only going to slow things down and throw roadblocks in your way. “Act deferentially to the Department of Labor in any investigation,” Abrahams cautions.”You’ll want to be respectful of the wage and hours investigators, with a goal of conciliating, settling, and resolving these issues short of litigation if you can, or joining litigation as soon as you’re able.”

Take corrective action with legal counsel. Don’t let this become an ongoing violation. Work with your attorney to evaluate your policies, take corrective action as advised, and fix the problem that caused this in the first place.

Daniel Abrahams and Lee Schreter offer more advice about how to respond to FLSA wage and hours lawsuits alongside fellow employment law attorney Maria Hart from Parsons Behle & Latimer in What You Need to Know About FLSA Wage and Hour Lawsuits.

The most important step is preparation—either by preventing a lawsuit from happening in the first place or knowing what to expect, and how to proceed, if a lawsuit does find you.