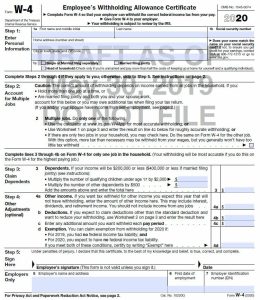

Late last month, the IRS released a draft of the 2020 form W-4. The IRS is now accepting comments and suggestions before issuing a “near final” draft next month. The new W-4 doesn’t rely on personal exemptions the way the current form W-4 does.

Along with this potentially big change, another big change is also looming – this one from the Department of Labor (DOL). The DOL’s new compensation guidelines regarding FLSA overtime pay for salaried workers, if approved — and it’s expected they will — are projected to go into effect on January 1, 2020. The new rule requires employers to pay overtime to most workers earning $679 or less per week (equivalent to $35,308 per year).

This gives organizations six months to identify, evaluate, and prepare to pay overtime to employees who will be eligible under this change. Some may think that is plenty of time, but others will undoubtedly be wishing for a longer runway.

Evaluate current employees

If the IRS takes this new overtime policy into account, payroll and HR professionals will need to look into each of their employees’ pay grades to see how many of them will now be eligible for OT. Depending on the results, organizations might decide to provide salary increases to employees who can be considered exempt under the job duties test, but just barely fail to meet the $35,308 salary minimum.

Organizations should also look into the number of hours the staff is working to decide whether or not they will be considered a non-exempt worker under the new guidelines. Compliance is the critical reason, but figuring out the financial impact now has major implications for budgeting and developing rules in-house regarding authorizing OT.

Start tracking time

When the proposed overtime rule change was first announced in 2016, a Kronos survey found that 39% of all salaried employees were not required to track and report their time. Of those employed by organizations that did not require time tracking, 77% of employees reported working outside of standard work hours, creating a potential wage and hour dispute. Surveys by organizations like the American Payroll Association have resulted in similar findings since then.

While the majority of salaried employees don’t track their time, some organizations do require it. The impending changes to the FLSA OT guidelines are a good enough reason for more organizations to require time tracking. This is most easily done with a system that is accessible and intuitive, resulting in more accurate hour tracking than relying on the pencil and paper method. Integrating timekeeping and payroll in the same solution streamlines the calculations and makes accessing the information you’ll need to determine who will be eligible for overtime pay and what the potential financial impact might be.

Stay accountable for telecommuters

This overtime rule includes remote workers as well as onsite employees. If the organization has a large population of employees working from home on a consistent basis, it will become important to ask employees to track, report, and attest to work hours more closely.

Trust is important, but so is a clear policy and reliable tool that makes it easy for everyone to record when they are on and off the clock. This might involve looking into better mobile access options so it’s easy for remote employees to punch from a phone or tablet.

Communicate the new rules

Whether an organization has a large or small number of employees impacted by the potential policy change, transparency about how it will affect payroll dynamics is vital. Some employees that previously did not meet the non-exempt requirements may be eligible if their salaries lie between $23,661 (the current dividing line between exempt and non-exempt) and $35,307. Make sure all managers convey how this policy might affect workers’ pay and tasks.

A company-wide town hall meeting may be the best way to explain the new policy, but employees who are directly impacted should feel comfortable approaching payroll staff or their managers about any concerns or questions. Technology can be a big help here since it will help automate some of these communications or assign actions to employees if they need to change some of their information.

Don’t wait

Whether the new OT guidelines become rule next week, next month, next year, or not at all, organizations shouldn’t wait until there is a date circled on the calendar to start preparing. Evaluating job duties, tracking time, staying accountable, and communicating aren’t just important for compliance – they’re all the basic building blocks any organization will need to put in place if they hope to build a highly engaged, high performing workforce.