Walmart reversed an earlier decision last week and announced it would no longer cover spouses or provide health benefits to future part-time employees.

At the same time, the news coverage reported that Walmart will apply a tobacco surcharge and reduce its funding of employees’ health savings accounts. These accounts are coupled with high-deductible health plans and help employees cover some of their out-of-pocket expenses.

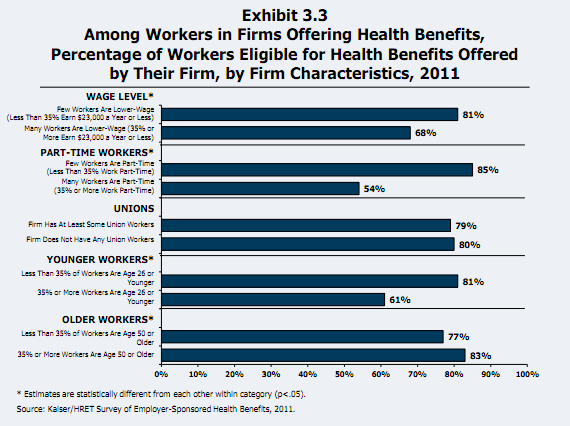

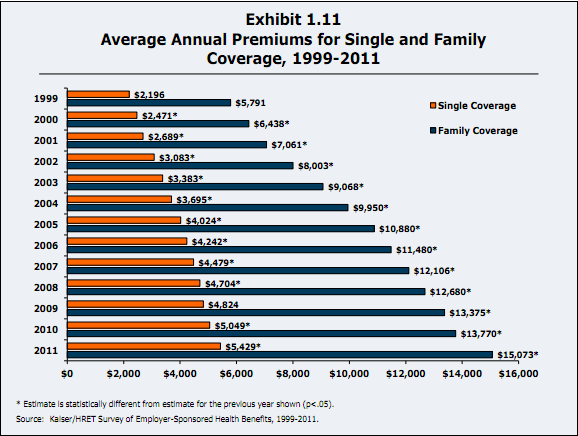

Walmart’s decision got a lot of press, but as The New York Times and some other articles noted, what Walmart’s doing is not atypical. I pulled a few charts from the Kaiser Family Foundation’s Employer Health Benefits 2011 annual survey to prove the point. As this chart shows below, employers frequently don’t offer part-time workers health benefits. Those employers who continue to offer benefits to part-timers are facing the same rising health care costs all companies are seeing. And those cost’s are more frequently being shared with employees. In the next chart below, you can see that the average annual premium for an individual is $5,429.

Those employers who continue to offer benefits to part-timers are facing the same rising health care costs all companies are seeing. And those cost’s are more frequently being shared with employees. In the next chart below, you can see that the average annual premium for an individual is $5,429.

Knowing the trends and averages helps put reported stories like this in perspective:

Tammy Yancey, a $9.50-an-hour gas attendant at a Sam’s Club in Pinellas Park , Fla., complained that she would no longer be able to afford health insurance from the company. Ms. Yancey, a smoker, said her premiums would jump to $127.90 every two weeks — or $3,325 a year — up from $53.80 at present, when she earns $12,000 a year from her job.”

Tammy Yancey’s costs are rising, yet her premiums are still less than the average individual’s.

Tammy Yancey’s costs are rising, yet her premiums are still less than the average individual’s.

Tobacco surcharges are also not news. A study by Hewitt (now Aon Hewitt) found that 64 percent of companies impose or plan to impose a tobacco surcharge. Some companies have already gone beyond surcharges and stopped hiring tobacco users altogether.

It’s yet to be seen how well the “stick” will work versus more supportive methods such as creating a tobacco-free workplace, or as in Walmart’s case, not selling tobacco while trying to get employees to quit. That presents a situation that’s tough to message.

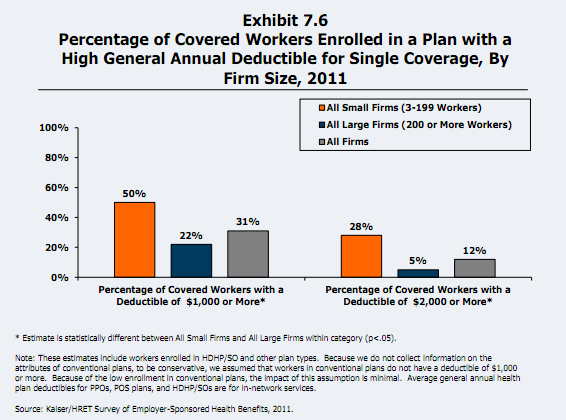

It’s become common for employers to offer plans with high deductibles. We’re likely to see 73 percent of employers offer a high-deductible health plan and 47 percent offering only them.

While painful, Walmart’s decision isn’t outside the norm. Walmart reversed itself in response to changing economic times. They have tighter margins and tons of people knocking down their door for a job.

While painful, Walmart’s decision isn’t outside the norm. Walmart reversed itself in response to changing economic times. They have tighter margins and tons of people knocking down their door for a job.

Employer interest in being an employer of choice waxes and wanes depending on where we are in the “talent wars.” And right now, the war is being fought by employees, not employers.

So the bigger question is not whether what Walmart has done is “right.” It’s whether Walmart’s decision signals anything unknown about the future of employer-provided health benefits.

Will more employers move to part-time and contract workers as a way to manage rising health care costs? Will they continue to rewrite their eligibility rules? Will employers consider the $153 billion in lost productivity because of health conditions while they pare back health benefits?

This was originally published on Fran Melmed’s Free-Range Communication blog.