If you want to look more deeply into why hiring will continue to lag, just turn on the news and you’ll see the biggest reason in the headlines this week: economic uncertainty continues to keep company pockets buttoned tight when it comes to adding to their workforce.

Whether it is Greece and the European debt, Iranian saber rattling, the U.S.’s own inability to manage their finances, or variability in global demand, all of that is what businesses are looking at while they keep their cash reserves stacked neatly in savings rather than investing in employees.

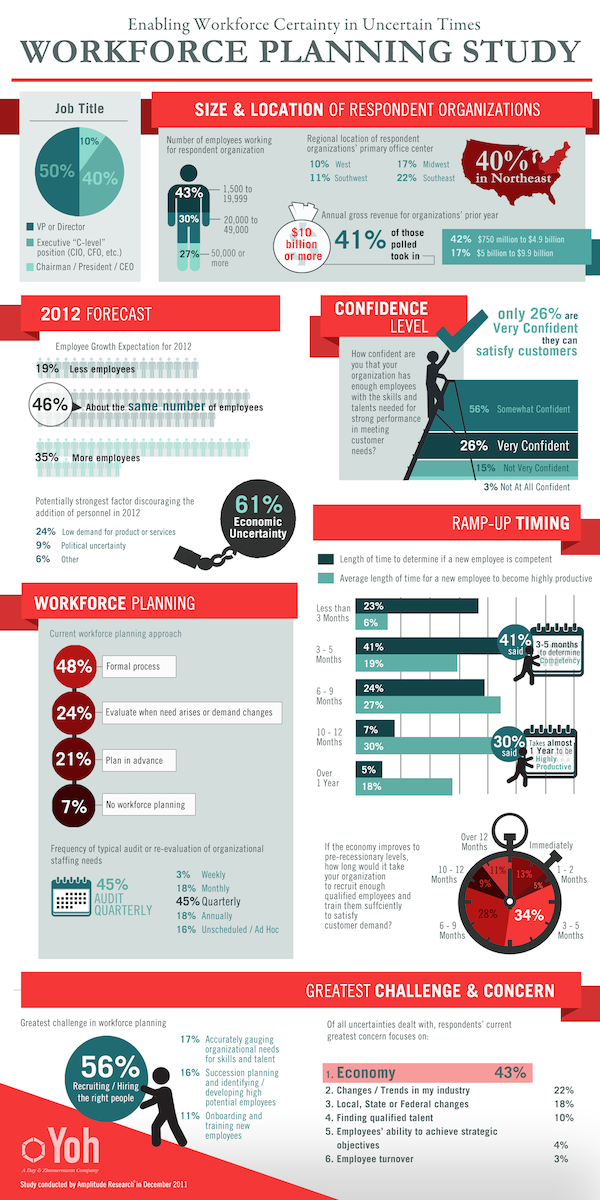

That’s just one of a handful of trends that a recent workforce planning survey covered.

November a distant idea

The survey by Amplitude Research and commissioned by outsourcing provider Yoh covered a wide variety of workforce planning topics but what stood out to me was something I wrote about last week:

In short, we’re not out of the woods yet but we’re a step closer in many respects than we were a year ago. With elections around the corner, you know it will be a hot topic in all of the local, state and national contests taking place.

But with due respect to our dear politicians, this one issue is probably bigger than them. They might be able to help (or hurt) somewhat, but the actions businesses (and the global economy as a whole) take are going to take precedence over anything decided in November.”

The perception that the political uncertainty 2012 brings may be a leading obstacle to hiring is a non-issue according to the survey. Only 9 percent of those surveyed cited it while a vast majority cited uncertain economics and product demand as the biggest factor slowing the hiring of new employees.

Politicians can say what they like about creating jobs, but stabilizing the world economy and creating demand for products is beyond the office of anyone — even the President of the United States.

Some 35% expect to add jobs

Some other interesting tidbits from the survey included:

- 35 percent expect to add jobs this year with 46 percent expecting to stay at the same level. That being said, almost 20 percent looking to lose jobs is a problem.

- Only 26 percent are very confident they can adequately meet the needs of their customers with their current staffing and training levels. Employers are making due with less employees to keep their payroll as lean as possible but that has reduced confidence that they are adequately serving customers.

- Less than half do formal workforce planning. Not surprisingly, most do some sort of informal, seat of their pants workforce planning. That might be doable now but in periods of sustained growth, companies will have to spend more resources on this key issue.

- 4 in 5 evaluate their staffing levels either quarterly or less frequently. As changes become more rapid, it is probably wiser to evaluate with more frequency. In a longer term flat or sustained growth model, it might make sense to look at staffing levels quarterly though.

- A majority of those surveyed estimated it would take 3-9 months to get their workforce back to pre-recession levels of demand. Even if a rapid improvement in the economy takes place over the next year, it could take an additional amount of time to staff back up to those levels.

Take a look at all of the results on the handy infographic below and for more information about the study and infographic (and how you can get a free copy), you can visit the original Yoh post about the study.