When a company like IBM makes a big, ground-breaking employee benefits change, a lot of people sit up and notice.

That’s why The Wall Street Journal story about how IBM plans to change how it handles 401(k) contributions to a yearly, lump sum is such a big deal — because it could encourage other companies to do the same thing to their employees.

Here’s the gist of it, according to the WSJ:

International Business Machines Corp., a bellwether for employee benefits, is overhauling its retirement program to contribute once a year to employee 401(k) accounts in a lump-sum payment.

Starting next year, IBM’s contributions, which generally range from 6 percent to 10 percent of pay, will take place Dec. 31. Workers who leave the company before Dec. 15 won’t qualify for the match, unless they retire. …

Benefits experts say IBM’s shift could start a trend among other large employers. Earlier this year Ford said it would offer retirees a lump-sum payout to offset its pension obligations. General Motors and about a dozen other companies quickly followed suit, according to the Pension Rights Center, a Washington, D.C., advocacy group.

For IBM, the latest move could help save millions of dollars a year in compensation expenses, and keep valued workers who want to ensure they receive the match more tethered to their jobs — at least until the end of a given year.”

Why this 401(k) change matters

Here are few reasons why this is a big deal:

- It encourages others. Having a company the size and scope of IBM — an organization that has frequently been a trend-setter in benefit offerings — implement a policy like this is bound to encourage many other companies to follow suit.

- It saves money for the company at the expense of the employee. If matching 401(k) funds are paid in one lump sum in December rather than regularly throughout the year, employees won’t get the potential benefit that comes from investing smaller amounts of money on a more regular basis (this is commonly referred to as dollar-cost averaging).

- Employees who leave before the magic date will get stiffed. Unless an employee is on the payroll on the magic date when the lump sum gets paid — and IBM has designated Dec. 15 as that magic date — they will get no matching funds at all. For instance, someone could depart for a new job at the end of November and lose 11 months worth of matching 401(k) funds because they couldn’t stick around for another two-weeks until the payout is made. (Some feel this is actually a smart retention strategy.)

In a world where traditional pensions are just about gone (except for all those lucky government employees), and 401(k)s have been touted as a better way to do it, this is a cruel joke. If the whole point of a 401(k) plan is to make employees take more responsibility for actively managing their retirement accounts, this would seem to take away a big chunk of that by severely limiting what they have to manage.

Another reason to be disengaged

The Wall Street Journal talked to IBM employees who are, not surprisingly, pretty unhappy about the change

It’s a huge change,” said Andy Maher, a 59-year-old IBM customer engineer in Victorville, Calif. Mr. Maher, who started at the company in 1976, was an early adopter in the company’s retirement offerings, eventually increasing his savings to 12 percent of pretax pay while raising five children.

Now, he said, he is concerned that “you lose a whole year’s worth of interest on that money. And if they lay you off Dec. 1, you don’t get anything. It adds a whole other level of unnecessary uncertainty.”

Some will say that this is simply a smart business move and that IBM is right to try to find ways to save money where they can.

Although I understand that thinking and agree that companies should always be looking for innovative ways to keep costs down, I can’t help but think that this is just one more slap at employees who are already fed up with the cutbacks, furloughs, pay freezes, and additional workloads that they have faced during the Great Recession and not-so-great recovery.

Or to put it another way, if employees were feeling incredibly disengaged before, how will an unfriendly move like this impact their engagement? It seems to me to be just another destructive and short-sighted corporate policy that is all about saving a few bucks without much concern for what it does to the overall state of the workforce.

Yes, this new 401(k) policy seems to be a lose-lose situation for all involved.

Part-time cutbacks because of Obamacare

Of course, there’s a lot more than IBM’s 401(k) changes in the news this week. Here are some HR and workplace-related items you may have missed. This is TLNT’s weekly round-up of news, trends, and insights from the world of talent management. I do it so you don’t have to.

- Bank of America cutting back work-at-home options. Working from home is a big workplace trend, but Bank of America seems to be having second thoughts about it. According to the Charlotte Observer, “Bank of America is preparing to add more restrictions to its popular work-from-home program, meaning more employees across the company will be sent back to the office more often … The program, known as “My Work,” had grown significantly since it was introduced in 2005 and was widely touted as a cost-saver. It also has proved popular with employees who say it saves on commuting costs and helps them balance work and family. Now the bank has asked department managers to determine which job categories would better serve the bank by having workers come into the office, a bank spokeswoman said.”

- FexEx offering two-years pay for buyouts. I’ve seen a lot of buyouts and buyout packages, and I have almost never seen people taking the buyout getting more than a year’s pay, tops. And, that’s why this Associated Press story in the Seattle Times is so surprising: “FedEx said Tuesday that it will be offering some employees up to two years’ pay to leave the company starting next year. The voluntary program is part of an effort by the world’s second-biggest package delivery company to cut annual costs by $1.7 billion within three years. … Employees who volunteer for the program will receive four weeks of pay for every year of service, capped at two full years of base pay. FedEx has said previously that the buyouts should reduce “fixed head count by several thousand people.”

- Part-time cutbacks due to fears over Obamacare. Now that Health Care Reform seems fairly certain, companies are trying to cope. And some of that coping means cutting hours for part-time workers. As the Des Moines Register reports, “More than 50 uninsured part-time workers for the city of Cedar Falls will see their hours cut this week so the city can avoid paying for their health insurance under President Barack Obama’s signature health care law. … Under the law, businesses and government entities with 50 or more workers must provide health insurance coverage to their full-time employees or face penalties. Coverage doesn’t have to be provided to workers who log less than an average of 30 hours per week. Cedar Falls’ move to reduce part-time employees’ hours comes in the wake of representatives from national food chains like Papa John’s Pizza, Red Lobster and Olive Garden saying they would likely see employee hours cut to avoid the additional costs of providing health care insurance.”

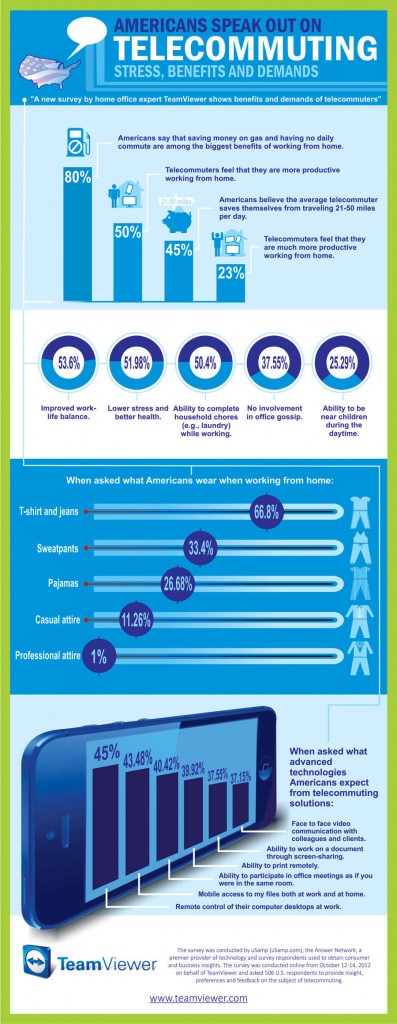

- The benefits of telecommuting? This informational graphic from TeamViewer (above left), a company that says it “is fully focused on the development and distribution of high-end solutions for online communication and collaboration,” is pretty interesting and gives you some sense of how workers feel about this growing trend (unless you work for BofA, of course).