Most people will recall that over the summer, the consumer prices rose by 3.0% – and this was on top of a 4.0% increase over the previous months, according to the Bureau of Labor Statistics.

This consequence of this year’s rising inflation (plus higher costs of living), is that according to our 2023 Healthcare and Employee Benefits Benchmarking Report, many employers have either already updated their benefits plans and practices, or are considering doing so, to help employees withstand difficult economic times.

In fact, with companies closely examining their healthcare and employee benefits, there are five main trends that we can say are happening:

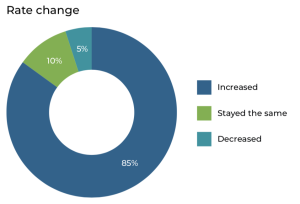

Rate increases matched predictions

The Benchmarking Report shows 85% of the medical plans that went unchanged from the past year in terms of plan design experienced an average 8% increase in price, marking rising medical premium a significant trend for the majority of employers.

But ongoing increases in rates shouldn’t come as a surprise, however, as the insurance industry has been vigilantly tracking rising costs for several years.

Earlier this year, industry analysts cited a persistent rise in the annual trend factor for medical and pharmacy costs, signaling significant rate hikes for employers should be expected for the rest of 2023 and beyond.

Employee retention remains top priority

The traditional workplace has evolved drastically in recent years, largely due to the Covid-19 pandemic. Shifting between in-office and remote work has created uncertainty and significantly impacted employees’ mental health, along with other concerns the pandemic has introduced.

The Benchmarking Report revealed that employers are supporting employees’ mental health and promoting worker retention by offering supplemental benefits and expanded telehealth services for behavioral health and substance abuse.

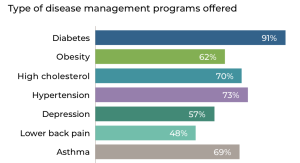

Further proving many industries’ recent focus on mental health, our survey found that almost half (47%) of the participants reviewed offered wellness programs to support employees.

And when disease management programs are offered, they are typically targeted toward common conditions that drive healthcare spending, particularly diabetes, hypertension and high cholesterol.

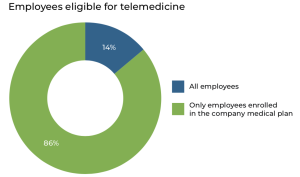

Another growing trend employers have embraced is telemedicine, which allows employees to access healthcare in a convenient and affordable – if not financially burdenless – way.

Pharmacy specialty tiers multiply

All year long, there’s been talk across the industry of the growing trend of having pharmacy specialty tiers.

Simply put, a plan’s formulary might have three, four or even five tiers.

In general, the lowest-tier drugs – often generic labels – are also the lowest-cost.

Tier 5 pharmaceuticals – specialty drugs used to treat complex conditions such as cancer and multiple sclerosis – are typically the most expensive on the list.

The Benchmarking Report shows that 57% of prescription plans include four or more formulary tiers.

One interesting finding related to pharmacy specialty tiers is that the majority of plans (87%) do not cover “new drug” therapies, while only 21% of plans make generic drug coverage mandatory.

Employees with severe health issues are advised to communicate with their employers to see if their plan covers Tier 4 or 5 drugs.

But as costs continue to rise, it will be interesting to watch this trend and see which, if any, changes will occur over time.

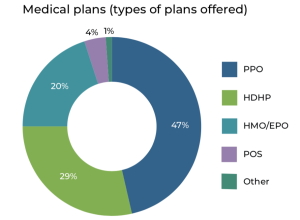

The domination of PPO plans and HSAs

The proliferation of preferred provider organizations (PPO) and health savings accounts (HSAs) continues.

The Benchmarking Report found that a PPO is still the most popular type of medical plan, with a 47% prevalence out of all medical plans.

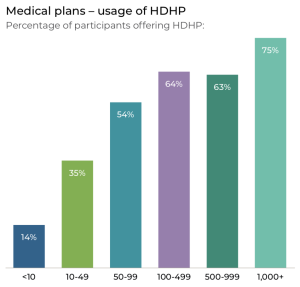

It’s worth noting that among large employers, that high-deductible health plans (HDHPs) are commonly offered.

While only 29% of the medical plans included in the benchmarking survey qualify as a HDHP, the number of times they’re offered increases with the size of the company. Larger companies, with more than 100 employees, are more likely to offer several medical plans than their smaller counterparts. As such, they typically include an HDHP option.

Within the category of health plans that meet the criteria for HDHPs, a substantial 82% incorporate an HSA, with a noteworthy 60% of these plans going the extra mile by including contributions to the HSA from the employer’s end.

Communication is key

Employees encounter a good deal of insurance jargon, and many employers have noticed that excessive technical language could be confusing, often hindering employees’ ability to make informed decisions for themselves or their family.

We always tell employers to simplify this often-tiresome process by streamlining their communications to ensure clarity and transparency, thus helping all employees understand their benefits.

During open enrollment season, clear and effective communication is of utmost importance as employees make choices regarding their enrollment in group-benefit programs.

HR professionals, already burdened with year-end tasks, frequently face a surge in inquiries about benefits and enrollment procedures.

The solution to this challenge lies in clear and simple open enrollment communications, especially in a multi-generational workforce.